Showing archive for: “Patents”

The FTC Office of Patent Invalidation

The Federal Trade Commission (FTC) announced late last month that it had “expanded its campaign against pharmaceutical manufacturers’ improper or inaccurate listing of patents in the Food and Drug Administration’s (FDA) Orange Book, disputing junk patent listings for diabetes, weight loss, asthma, and COPD drugs, including Novo Nordisk Inc.’s blockbuster weight-loss drug, Ozempic.” Warning letters ... The FTC Office of Patent Invalidation

March-Right-on-In Rights?

The National Institute for Standards and Technology (NIST) published a request for information (RFI) in December 2023 on its “Draft Interagency Guidance Framework for Considering the Exercise of March-In Rights.” It’s quite something, if not in a good way. March-In Rights Provide Very Limited Exceptions to Intellectual-Property Rights What are “march-in” rights? In brief, they ... March-Right-on-In Rights?

Using Bayh-Dole March-in to Set Patent Price Controls: An Assault on American Innovation

Under the Bayh-Dole Act, the federal government has the right to “march in” on patents on inventions created using taxpayer funds—to require the patentholder to license the federally funded patent to other applicants. The terms of the license must be “reasonable under the circumstances.” The act limits the exercise of march-in to specific circumstances related ... Using Bayh-Dole March-in to Set Patent Price Controls: An Assault on American Innovation

The FTC’s Misguided Campaign to Expand Bayh-Dole ‘March-In’ Rights

The Federal Trade Commission (FTC) has now gone on record in comments to the National Institute of Standards and Technology (NIST) that it supports expanded “march-in rights” under the Bayh-Dole Act (Act). But if NIST takes the FTC’s (unexpected, but ultimately unsurprising) contribution seriously, such an expansion could lead to overregulation that would ultimately hurt ... The FTC’s Misguided Campaign to Expand Bayh-Dole ‘March-In’ Rights

The FTC Tacks Into the Gale, Battening No Hatches: Part 1

The Evolution of FTC Antitrust Enforcement – Highlights of Its Origins and Major Trends 1910-1914 – Creation and Launch The election of 1912, which led to the creation of the Federal Trade Commission (FTC), occurred at the apex of the Progressive Era. Since antebellum times, Grover Cleveland had been the only Democrat elected as president. ... The FTC Tacks Into the Gale, Battening No Hatches: Part 1

If Necessity Is the Mother of Invention, New EU SEP Rules Are Decidedly Unnecessary

An unofficial version of the EU’s anticipated regulatory proposal on standard essential patents (SEPs), along with a related impact assessment, was leaked earlier this month, generating reactions that range from disquiet to disbelief (but mostly disbelief). Our friend Igor Nikolic wrote about it here on Truth on the Market, and we share his his concern that: As it currently stands, it appears the regulation will ... If Necessity Is the Mother of Invention, New EU SEP Rules Are Decidedly Unnecessary

European Commission’s Leaked SEP Regulation Would Increase Costs for Innovators, Hurt EU Competitiveness, and Fail to Reduce Litigation

The European Commission is working on a legislative proposal that would regulate the licensing framework for standard-essential patents (SEPs). A regulatory proposal leaked to the press has already been the subject of extensive commentary (see here, here, and here). The proposed regulation apparently will include a complete overhaul of the current SEP-licensing system and will ... European Commission’s Leaked SEP Regulation Would Increase Costs for Innovators, Hurt EU Competitiveness, and Fail to Reduce Litigation

A Few Questions (and Even Fewer Answers) About What Artificial Intelligence Will Mean for Copyright

Not only have digital-image generators like Stable Diffusion, DALL-E, and Midjourney—which make use of deep-learning models and other artificial-intelligence (AI) systems—created some incredible (and sometimes creepy – see above) visual art, but they’ve engendered a good deal of controversy, as well. Human artists have banded together as part of a fledgling anti-AI campaign; lawsuits have ... A Few Questions (and Even Fewer Answers) About What Artificial Intelligence Will Mean for Copyright

Why I’m a Skeptic of a Noncompete Ban

Under a recently proposed rule, the Federal Trade Commission (FTC) would ban the use of noncompete terms in employment agreements nationwide. Noncompetes are contracts that workers sign saying they agree to not work for the employer’s competitors for a certain period. The FTC’s rule would be a major policy change, regulating future contracts and retroactively ... Why I’m a Skeptic of a Noncompete Ban

Brussels Effect or Brussels Defect: Digital Regulation in Emerging Markets

The blistering pace at which the European Union put forward and adopted the Digital Markets Act (DMA) has attracted the attention of legislators across the globe. In its wake, countries such as South Africa, India, Brazil, and Turkey have all contemplated digital-market regulations inspired by the DMA (and other models of regulation, such as the ... Brussels Effect or Brussels Defect: Digital Regulation in Emerging Markets

Patent Pools, Innovation, and Antitrust Policy

Late last month, 25 former judges and government officials, legal academics and economists who are experts in antitrust and intellectual property law submitted a letter to Assistant Attorney General Jonathan Kanter in support of the U.S. Justice Department’s (DOJ) July 2020 Avanci business-review letter (ABRL) dealing with patent pools. The pro-Avanci letter was offered in ... Patent Pools, Innovation, and Antitrust Policy

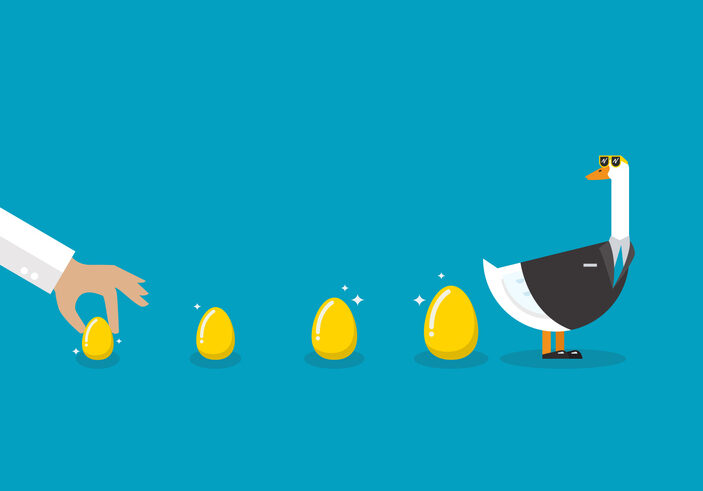

FCC Auctions and the Benefits of Unlicensed Spectrum

What should a government do when it owns geese that lay golden eggs? Should it sell the geese to fund government programs? Or should it let them run wild so everyone can have a chance at a golden egg? That’s the question facing Congress as it considers re-authorizing the Federal Communications Commission’s (FCC’s) authority to ... FCC Auctions and the Benefits of Unlicensed Spectrum