Brussels Effect or Brussels Defect: Digital Regulation in Emerging Markets

The blistering pace at which the European Union put forward and adopted the Digital Markets Act (DMA) has attracted the attention of legislators across the globe. In its wake, countries such as South Africa, India, Brazil, and Turkey have all contemplated digital-market regulations inspired by the DMA (and other models of regulation, such as the ... Brussels Effect or Brussels Defect: Digital Regulation in Emerging Markets

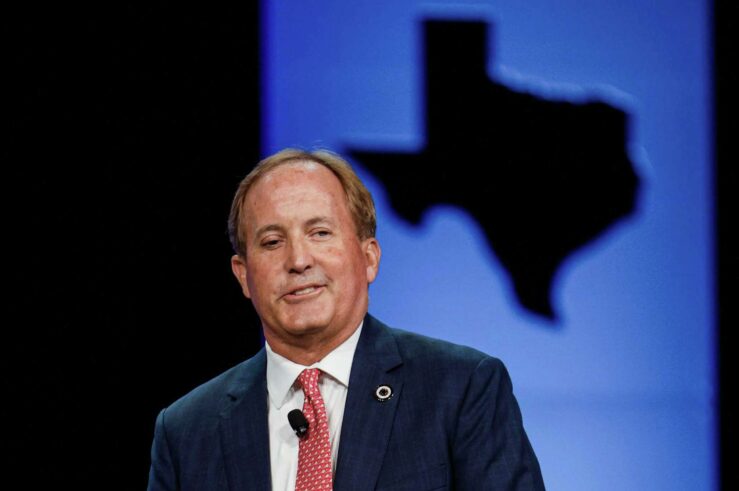

AG Paxton’s Google Suit Makes the Perfect the Enemy of the Good

Having just comfortably secured re-election to a third term, embattled Texas Attorney General Ken Paxton is likely to want to change the subject from investigations of his own conduct to a topic where he feels on much firmer ground: the 16-state lawsuit he currently leads accusing Google of monopolizing a segment of the digital advertising ... AG Paxton’s Google Suit Makes the Perfect the Enemy of the Good

The Catch-22 of AICOA’s Guidelines

If S.2992—the American Innovation and Choice Online Act or AICOA—were to become law, it would be, at the very least, an incomplete law. By design—and not for good reason, but for political expediency—AICOA is riddled with intentional uncertainty. In theory, the law’s glaring definitional deficiencies are meant to be rectified by “expert” agencies (i.e., the ... The Catch-22 of AICOA’s Guidelines

How Tech Startups Could Be a Casualty of the War on Self-Preferencing

We will learn more in the coming weeks about the fate of the proposed American Innovation and Choice Online Act (AICOA), legislation sponsored by Sens. Amy Klobuchar (D-Minn.) and Chuck Grassley (R-Iowa) that would, among other things, prohibit “self-preferencing” by large digital platforms like Google, Amazon, Facebook, Apple, and Microsoft. But while the bill has ... How Tech Startups Could Be a Casualty of the War on Self-Preferencing

The ABA’s Antitrust Law Section Sounds the Alarm on Klobuchar-Grassley

Sens. Amy Klobuchar (D-Minn.) and Chuck Grassley (R-Iowa)—cosponsors of the American Innovation Online and Choice Act, which seeks to “rein in” tech companies like Apple, Google, Meta, and Amazon—contend that “everyone acknowledges the problems posed by dominant online platforms.” In their framing, it is simply an acknowledged fact that U.S. antitrust law has not kept ... The ABA’s Antitrust Law Section Sounds the Alarm on Klobuchar-Grassley

Assessing Less Restrictive Alternatives and Interbrand Competition in Epic v Apple

The International Center for Law & Economics (ICLE) filed an amicus brief on behalf of itself and 26 distinguished law & economics scholars with the 9th U.S. Circuit Court of Appeals in the hotly anticipated and intensely important Epic Games v Apple case. A fantastic group of attorneys from White & Case generously assisted us ... Assessing Less Restrictive Alternatives and Interbrand Competition in Epic v Apple

Unpacking the Flawed 2021 Draft USPTO, NIST, & DOJ Policy Statement on Standard-Essential Patents (SEPs)

Responding to a new draft policy statement from the U.S. Patent & Trademark Office (USPTO), the National Institute of Standards and Technology (NIST), and the U.S. Department of Justice, Antitrust Division (DOJ) regarding remedies for infringement of standard-essential patents (SEPs), a group of 19 distinguished law, economics, and business scholars convened by the International Center ... Unpacking the Flawed 2021 Draft USPTO, NIST, & DOJ Policy Statement on Standard-Essential Patents (SEPs)

The Return of (De Facto) Rate Regulation: Title II Will Slow Broadband Deployment and Access

President Joe Biden’s nomination of Gigi Sohn to serve on the Federal Communications Commission (FCC)—scheduled for a second hearing before the Senate Commerce Committee Feb. 9—has been met with speculation that it presages renewed efforts at the FCC to enforce net neutrality. A veteran of tech policy battles, Sohn served as counselor to former FCC ... The Return of (De Facto) Rate Regulation: Title II Will Slow Broadband Deployment and Access

Fleites v. MindGeek Contemplates Significant Expansion of Collateral Liability

In Fleites v. MindGeek—currently before the U.S. District Court for the District of Central California, Southern Division—plaintiffs seek to hold MindGeek subsidiary PornHub liable for alleged instances of human trafficking under the Racketeer Influenced and Corrupt Organizations (RICO) and the Trafficking Victims Protection Reauthorization Act (TVPRA). Writing for the International Center for Law & Economics ... Fleites v. MindGeek Contemplates Significant Expansion of Collateral Liability

Amazon Italy’s Efficiency Offense

Early last month, the Italian competition authority issued a record 1.128 billion euro fine against Amazon for abuse of dominance under Article 102 of the Treaty on the Functioning of the European Union (TFEU). In its order, the Agenzia Garante della Concorrenza e del Mercato (AGCM) essentially argues that Amazon has combined its Amazon.it marketplace ... Amazon Italy’s Efficiency Offense

5 Thoughts on the Senate’s Proposed Platform Self-Preferencing Ban

A bipartisan group of senators unveiled legislation today that would dramatically curtail the ability of online platforms to “self-preference” their own services—for example, when Apple pre-installs its own Weather or Podcasts apps on the iPhone, giving it an advantage that independent apps don’t have. The measure accompanies a House bill that included similar provisions, with ... 5 Thoughts on the Senate’s Proposed Platform Self-Preferencing Ban

Is There Any Market Power in Online Display Advertising?

A lawsuit filed by the State of Texas and nine other states in December 2020 alleges, among other things, that Google has engaged in anticompetitive conduct related to its online display-advertising business. Broadly, the Texas complaint (previously discussed in this TOTM symposium) alleges that Google possesses market power in ad-buying tools and in search, illustrated ... Is There Any Market Power in Online Display Advertising?