Showing results for: “sirius xm merger”

An FTC Complaint Against Amazon Gets Personal

There is much in the Federal Trade Commission’s (FTC) record over the past two years that could be categorized as abnormal. There is, for instance, nothing “normal” about using the threat of excessive force to cower businesses into submission. Introducing sky high costs for the filing of mergers isn’t normal, as it will scare away ... An FTC Complaint Against Amazon Gets Personal

Abandoning Antitrust Common Sense: The FTC’s New Normal?

This symposium wonders what exactly is “The FTC’s New Normal”? The short answer: scary. The current Federal Trade Commission (FTC) leadership is clear that old U.S. Supreme Court opinions, rather than more recent jurisprudence, are their lodestones for antitrust analysis. This is dramatically illustrated by the draft merger guidelines recently proposed by the FTC and ... Abandoning Antitrust Common Sense: The FTC’s New Normal?

Recent Antitrust and Regulatory Changes Both Unravel the Consensus

Presidential administrations over the last 50 years have pursued widely varying policy goals, but they have agreed—at least, in principle—that policies should be efficient and improve social welfare. Now, the Biden administration is taking steps to unravel that bipartisan consensus. We focus on different policy areas (Dudley on regulation and Sullivan on antitrust) and are ... Recent Antitrust and Regulatory Changes Both Unravel the Consensus

Antitrust at the Agencies Roundup: Take My Default … Please! Edition

I can hardly believe it, but I’ve read that a famous old bit by Henny Youngman has been purged from Florida textbooks, apparently because it was deemed offensive to those who wrote, told, and laughed at the joke. I won’t tell it here, but you can look it up. And if you’re a reader of ... Antitrust at the Agencies Roundup: Take My Default … Please! Edition

The FTC, DOJ, and International Competition Law: Convergence Away From the Consumer Welfare Standard?

In less than two and a half years, the Federal Trade Commission (FTC) and U.S. Justice Department (DOJ) have undone more than two decades of work aimed at moving global competition law toward an economics-friendly consumer welfare standard. In tandem with foreign competition authorities, the U.S. antitrust agencies are now cooperating in an effort to ... The FTC, DOJ, and International Competition Law: Convergence Away From the Consumer Welfare Standard?

The FTC Tacks Into the Gale, Battening No Hatches: Part 2

Part 1 of this piece can be found here. Emergence of the ‘Neo-Brandeisians’ Thus, matters unfolded until the curtain began to descend on the second Obama term in 2016. In the midst of presidential primary season, a targeted political challenge to the prevailing economic approach to antitrust first came to light. No one has yet ... The FTC Tacks Into the Gale, Battening No Hatches: Part 2

The FTC Tacks Into the Gale, Battening No Hatches: Part 1

The Evolution of FTC Antitrust Enforcement – Highlights of Its Origins and Major Trends 1910-1914 – Creation and Launch The election of 1912, which led to the creation of the Federal Trade Commission (FTC), occurred at the apex of the Progressive Era. Since antebellum times, Grover Cleveland had been the only Democrat elected as president. ... The FTC Tacks Into the Gale, Battening No Hatches: Part 1

The FTC’s New Normal

Over the past two years, the Federal Trade Commission (FTC) has operated differently than it has in recent decades. Characterized by—among other things—an enforcement-heavy approach to antitrust and consumer protection, a vigorous embrace of rulemaking, a skeptical approach to mergers, robust engagement with overseas counterparts, and centralization of decision-making within the Office of the Chair, ... The FTC’s New Normal

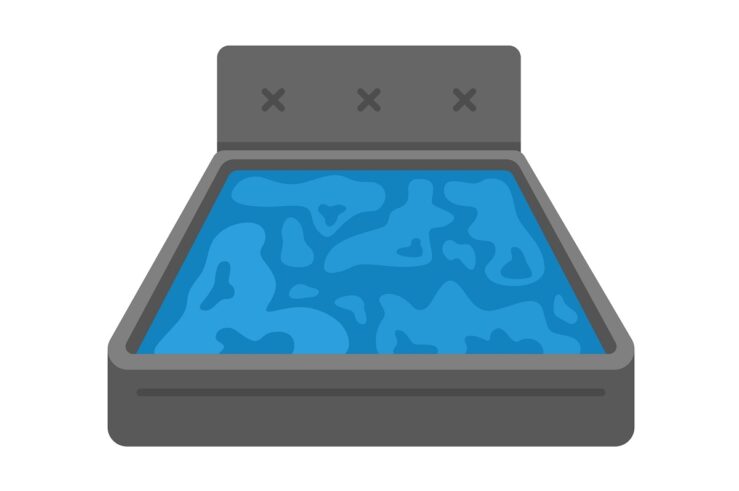

Sloshing Around with the ‘Waterbed Effect’

If you spend a lot of time in the world of competition policy—or any time at all on the announced Kroger/Albertsons merger—you will eventually stumble on the unfortunately named and greatly misunderstood “waterbed effect.” In a congressional hearing regarding the merger, this purported effect was mentioned at least a half-dozen times. If you were born ... Sloshing Around with the ‘Waterbed Effect’

Antitrust at the Agencies Roundup: Back to the Past Edition

Labor Day approaches with most of us looking forward to a long weekend off, but there’s much in competition world looming on the horizon. As I am looking forward to a couple of days off, I’ll offer more of an annotated bibliography than analysis. But also a bit of discussion, because I am what I ... Antitrust at the Agencies Roundup: Back to the Past Edition

When Greg Werden Talks, the Courts May Be Expected to Listen

Among the many public-interest comments submitted on the draft merger guidelines proposed by the U.S. Justice Department (DOJ) and Federal Trade Commission (FTC) were those of Gregory Werden, who has been a visiting scholar at the Mercatus Center at George Mason University since late 2022. Why is Greg’s filing special? Simply put, he is the ... When Greg Werden Talks, the Courts May Be Expected to Listen

Competition Increases Concentration

A market with 1,000 tiny sellers is not some ideal market. Concentration can be extremely beneficial, leading to economies of scale and stiffer competition to win a big share of the market. Yet the Federal Trade Commission (FTC) and U.S. Justice Department’s (DOJ) draft merger guidelines double down on the idea that concentration is inherently a problem. ... Competition Increases Concentration