I’ll start with a bit of half-empty, half-full (and very partial) resolution in Federal Trade Commission (FTC) publicity.

Losing by Winning or Just Losing or . . . ?

A couple of weeks ago, the Wall Street Journal editorial board announced that:

And that was right, up to a point (leaving aside the question of theory ownership). The FTC had suffered a setback in its antitrust case against Welsh, Carson, Anderson & Stowe and U.S. Anesthesia Partners, in which the agency alleged a “multi-year anticompetitive scheme to consolidate anesthesia practices in Texas, drive up the price of anesthesia services provided to Texas patients, and increase their own profits.”

If consolidation and scheming to increase one’s own profits (the heck you say!) don’t obviously scan as antitrust violations, the actual catalog of alleged violations starts on page 95 of the complaint: monopolization in the Houston hospital-only anesthesia market (under Sherman Act Section 2); “roll-up” in Houston (really, anticompetitive mergers or acquisitions under Clayton Act Section 7 and Section 5 of the FTC Act); conspiracy to monopolize, still in Houston (back to Section 2); monopolization (again for hospital-only anesthesia services, but this time for Dallas). They run the drill for Dallas, and a similar one for Austin; and also horizontal price fixing in both Houston and Dallas (under Section 1); and a horizontal market-allocation agreement (also under Section 1), apparently in Dallas, although a relevant part of the publicly available complaint is redacted.

So what happened? In an opinion and order dated May 13, Judge Kenneth Hoyt dismissed the claims against one of the two defendants: Welsh Carson, “a New York-based private equity firm,” according to the complaint. Basically, the FTC alleged ongoing anticompetitive threats under the Sherman Act, in part, because that facilitated their use of Section 13(b) of the FTC Act to seek injunctive relief. But while Welsh Carson continues to hold stock in the other defendant (U.S. Anesthesia Partners), it’s a minority, non-controlling shareholder. So, while it is receiving some profits, as a shareholder, from an allegedly anticompetitive scheme that they don’t control, that doesn’t make them liable for it (or a present threat). Not under existing precedent.

That is, indeed, a loss for the FTC, as the agency has been voicing concerns about the role of private equity in health care. See, e.g., the request for information (RFI) on consolidation jointly issued by the FTC, U.S. Justice Department (DOJ), and U.S. Department of Health and Human Services (HHS), which the FTC announced—in ever-so-neutral and academic fashion—as a “Cross-Government Inquiry on Impact of Corporate Greed in Health Care.”

On the other hand, it’s hardly a wholesale loss. The claims against U.S. Anesthesia Partners were not dismissed, and neither was the FTC’s “roll-up” acquisitions theory. Serial acquisitions, or “roll-ups,” are very much on the agencies’ radar right now. So, in addition to the case, and the health-care RFI above, the FTC and DOJ on May 23 jointly announced an RFI to “identify serial acquisitions, roll-ups that have harmed competition, consumers, workers, and innovation.”

From there on, it’s a tough call. It’s easy enough to imagine anticompetitive health-care-provider acquisitions. The antitrust controversy underlying the FTC’s landmark 9-0 win at the U.S. Supreme Court in the Phoebe Putney case (which was about FTC jurisdiction and the state-action doctrine) had to do with a merger to monopoly. And the FTC there had very good reasons—based on the investigation, the economic literature, and enforcement experience—to anticipate anticompetitive effects.

And it’s not just about hospitals. As FTC staff pointed out in 2019, anesthesia-services markets across much of Texas are (or were) highly concentrated, on any notion of “highly concentrated,” or worse. They noted, among other things, that most of the state’s critical-access hospitals were located in counties with no practicing anesthesiologists, with 37 of those hospitals located in counties where certified registered nurse anesthetists were the only licensed, specialized providers of anesthesia and anesthesia-related services. One might be rightly concerned about acquisitions–or other conduct–in a number of geographic markets in the state.

While there’s some intuitive appeal to the sort of death-by-a-thousand-cuts notion, there’s the question where in a series (or sequence) of acquisitions one can demonstrate an actual likelihood of competitive harm. So, for example, the alleged roll-up strategy in Houston began in earnest with a 2012 acquisition of an anesthesia group “billing itself as ‘20 times the size of the second largest local competitor.’” The complaint then tells us that “between 2014 and 2020, USAP acquired three of the largest remaining independent anesthesia groups in Houston.”

It might well be that one or more of those acquisitions should have been blocked. But which one or more? It’s not at all clear from the complaint that it’s the lot of them, or the eight-year string of acquisitions as a whole (but no single acquisition?), that caused whatever competitive harm is being alleged.

It’s a bit easier to imagine a marginal case in a smaller market, where there might be a colorable antitrust claim (say, under Section 7 of the Clayton Act), and where both the likelihood of harm and a colorable defense turn on the relative stability of a small or mid-sized practice group or two. That’s not impossible in a larger market, such as Houston or Dallas, but one would expect a more vivid and specific case to be made out, transaction by transaction, across the eight years in question, whether one is seeking to condemn a given transaction or the entire set of them.

Some sections of the complaint—in focusing on other markets in Texas and a “nationwide” scheme and pattern of acquisitions—do seem like frolic and detour. But I suppose, if one’s telling a story about a “scheme” and not just an acquisition or two or three, then maybe far-reaching tentacles are a feature of your story, not a bug.

Again, none of this is to argue that there are no viable antitrust allegations in the complaint. The FTC and its staff have brought many such complaints regarding health-care-provider acquisitions over the years, dating back long before the 2012-20 events cited now. But that’s partly why this all matters, and should be gotten right. And why there should be a clearer story, tied to precedent, research, and market-specific observations, about what went wrong and where.

Parts of this complaint appear obscure. Then again, a complaint is not the end of it, and parts of this one are redacted. So we’ll see.

By the way, if you’re wondering if there’s some special sense of “serial acquisition” at play, the “roll-up” RFI tells us that:

Serial acquisitions involve the same firm consolidating a fragmented market through a number of acquisitions, typically of many relatively small companies. When serial acquisitions occur, a company becomes larger, and potentially dominant, by buying several smaller firms in the same or related business sectors or industries.

That’s a start, but hardly precise. Multiple acquisitions, over time, comprise consolidation by which a company becomes larger (no kidding?) and potentially dominant. “Potentially dominant”; there’s the rub. What sort of potential are we talking about here? Maybe that’s enough of a sense for an inquiry, but then the first footnote tells us this:

For this Request for Information, the term, “serial acquisition” is interchangeable with “roll-ups,” “buy-and-build,” and “platform add-ons.”

And that seems to sweep broadly, indeed. Are all “platform add-ons” supposed to be of concern? All “buy-and-build”?

The ‘Win’ Column?

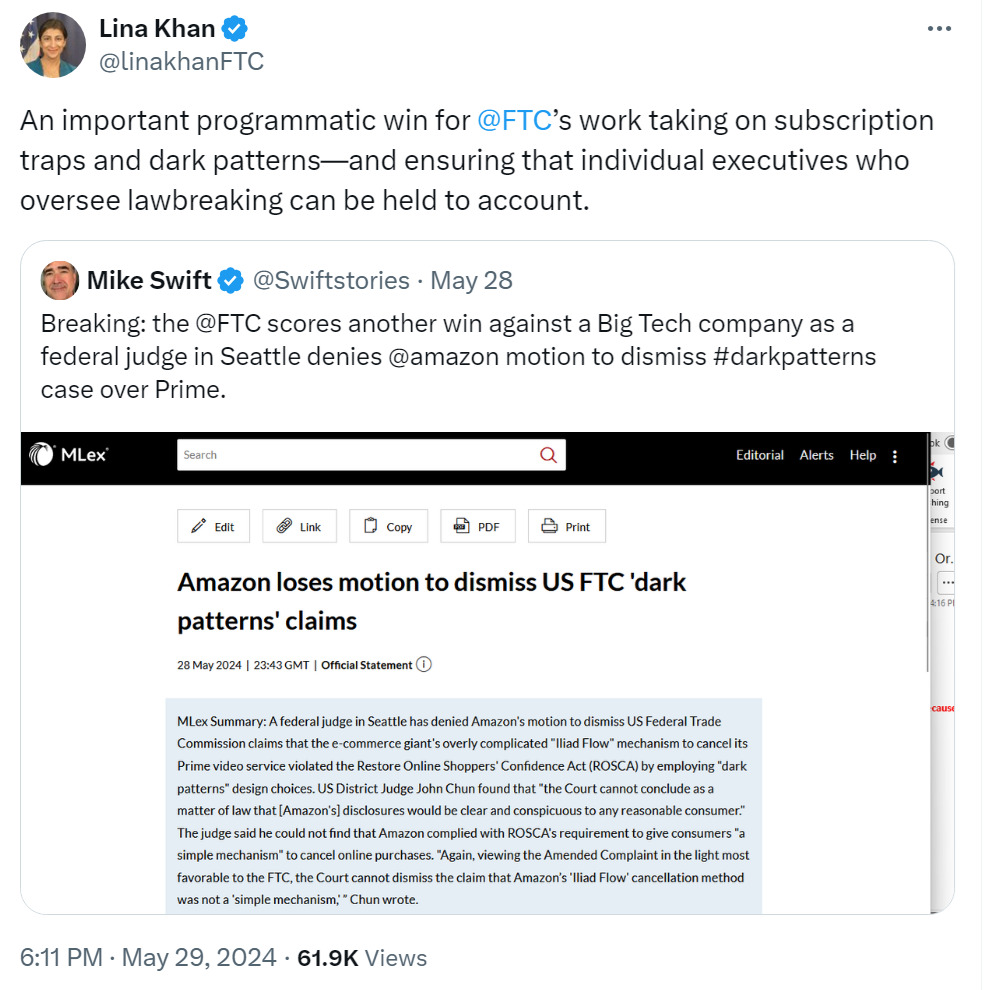

FTC Chair Lina Khan tweets about one of the commission’s serial allegations against Amazon:

That is, this consumer-protection matter, which I wrote about back in November 2023. For more, I’m here; Geoff Manne is here, and here with Lazar Radic.

“Traps” seem bad, and “dark patterns” dark (oooh) but patterned (ahhh), and . . . well, at the time, I expressed some skepticism about the FTC’s case. Ok, a lot of skepticism. I remain rich in skepticism.

But they won, right? As per Chair Khan’s tweet? I mean, I suppose you can call it a win with a lower-case small-font “w.” On May 28, Judge John Chun denied Amazon’s motion to dismiss (MTD) the FTC’s complaint, which had alleged violations of the FTC Act and the Restore Online Shoppers Confidence Act (ROSCA). To be fair to Khan and the staff, who have no doubt toiled hard and creatively at this, that’s a whole lot better for the plaintiffs than an order granting a motion to dismiss.

But then, it’s not like winning a litigated case on the merits, either. There’s some novelty in the “dark patterns” framing of the allegations, and drama in the language. A large firm “knowingly duped millions of consumers into unknowingly enrolling in its Amazon Prime service” (which, apparently, only a couple hundred million consumers actually want) with the “manipulative, coercive, or deceptive user-interface designs known as ‘dark patterns.’” And then, designing and implementing a cancellation process “not to enable subscribers to cancel, but, rather, to thwart them.”

I mean, it didn’t seem that hard to me–way easier than canceling a newspaper subscription or gym membership, never mind rebooking an airline ticket.

But leaving all that aside, look past the novelty of “dark patterns” and the atmospheric language, and the FTC Act allegations look like bread-and-butter allegations of UDAP (unfair or deceptive acts or practices): the agency is claiming that consumers were misled, materially and to their detriment, and in ways not offset by countervailing benefits to consumers or competition (as the statute requires).

To survive a motion to dismiss, they don’t have to show likely success on the merits. Rather, as Judge Chun rightly observed:

Because this matter comes before the Court on Rule 12(b)(6) [of the Federal Rules of Civil Procedure] motions to dismiss, the Court must accept as true the allegations in the Amended Complaint and must view them in the light most favorable to the FTC.

Some facts are not in dispute, but some are, as are any number of questions about how to view them with respect to the FTC Act and ROSCA allegations. Surviving the MTD is better than not, from the plaintiff’s point of view. That much is clear enough. But they jumped over a very low bar. There’s a long way to go before the medals stand in Paris. I mean, at the U.S. District Court in Seattle.

Once again, we’ll wait and see.

Noncompetes, Again with the Waiting

The Federal Trade Commission (FTC) swung for the fences in April 23’s open meeting. On purely partisan lines, the commission voted 3-2 to adopt a competition regulation that bans the use of noncompete agreements (NCAs) across much of the U.S. economy. With a few small wrinkles, it’s just what the FTC had proposed to do—also by a purely partisan vote—in its January 2023 notice of proposed rulemaking (NPRM).

As I also noted, along with many others, the FTC’s rule was bound to be controversial, and for several reasons. And, in fact, in less than 24 hours, it had been challenged in two federal district courts in Texas.

Dan Crane has an interesting post on the Yale Journal on Regulation’s “notice and comment” page. He polled a number of antitrust and administrative-law scholars, asking them to predict the rule’s fate. It was an unscientific survey (he knows this, and said so), but interesting all the same. All but one of his respondents predicted that the courts would invalidate the rule on some ground or other, with about half predicting that the matter would make its way to the U.S. Supreme Court.

Respondents were far from unanimous when it came to guessing the grounds on which the courts would repudiate the rule. One of the (anonymous) respondents was quoted as follows:

The hard question here is probably not whether the FTC loses, it’s how it loses.” They explained: “There are so many ways to challenge the rule that the mind fairly reels. FTC rulemaking authority, unconstitutional removal protections, nondelegation, major questions doctrine, arbitrary & capricious, etc. Plus, the rule’s novelty makes it a ripe target.”

Judge Ada Brown of the U.S. District Court for the Northern District of Texas has said that the court will issue a decision on the motion for a stay of the rule’s effective date (and a preliminary injunction) by July 3. But then, we’ll still be waiting for the real deal, and a decision on the merits of the challenge to the rule (challenges, that is—Ryan’s brief itself provides several grounds), and the question of the coalition challenge filed by the U.S. Chamber of Commerce in the Eastern District of Texas, plus likely appeals, perhaps on a fast track to the Supreme Court but perhaps not. So we shall see what we shall see, and when.

But Wait, There’s More Waiting!

The DOJ claims that Google has engaged in unlawful monopolization of two markets: general search and search ads. Closing arguments were offered early in May, but don’t hold your breath waiting for a decision. We’re likely to wait well past July 3 on this one—perhaps late summer, or perhaps well into the fall, but Judge Mehta hasn’t yet said.

I’m not going to recapitulate all the various arguments and commentary, except to note that the government’s case seems variously infirm. The question of liability aside, it’s hard to imagine a remedy that would make consumers better off than they are already.

If you’re looking for a quick take, Greg Werden blogged about it (here and here), I’ve discussed it (here, here, and here), and so have Sam Bowman and Geoff Manne (here). And many more. If you’d rather watch a video, here’s Randy Picker.

There’s much more going on, but then, I’ve gone on a bit already. For those interested in the DOJ’s Live Nation-Ticketmaster case, well, there’s a lot at-issue there, but check out my colleagues Eric Fruits, Geoff Manne, and Brian Albrecht (here) in the meantime.