Innovations in payment systems are rapidly transforming the world economy. While Bitcoin, Ethereum, and other decentralized blockchain-based systems tend to garner much of the press (good and bad), centralized peer-to-peer (P2P) payment systems are far more common. (Note that I use the term P2P here in its original sense to mean all peer-to-peer transactions, which includes transactions between any combination of individuals, businesses, and other entities, such as governments and unincorporated associations.)

Innovative payment systems such as M-Pesa, AliPay and Paytm are expanding access to financial services, bringing informal and unbanked people into the formal economy. In so doing, they foster economic growth and increase the tax base.

In some cases, governments have supported such innovations—e.g., by creating an enabling regulatory environment. In other cases, however, governments have intervened in more radical—and sometimes counterproductive—ways. In several countries, government-run central banks have created payment systems that compete directly with the private-sector companies they regulate.

As I have documented (here, here, and here), the Central Bank of Brazil (BCB) foisted Pix on large banks while (temporarily) prohibiting a competing private provider from entering the market. BCB’s actions effectively crowded out private competition, leaving consumers with limited choices. It also had other harmful consequences.

Governments are also using other levers to promote their preferred payment systems. For example, many governments in Latin America require some payment-services providers (PSPs) to withhold and remit to the government some or all the value-added tax (VAT) due on a transaction, but have not extended this requirement to P2P players, thereby creating perverse incentives for participants to use their P2P system.

This post explores the effects of VAT-withholding taxes in Latin America, with a particular focus on the effects of their discriminatory application to certain payment services, most notably debit and credit cards.

Electronic Payments and the Collection of VAT

Many governments levy taxes at the point of sale. The most common form of such tax is value added tax (VAT), which is applied to transactions throughout the value chain. So, for example, a merchant will typically pay VAT on wholesale purchases and then charge VAT on their retail sale. In such a series of transactions, merchants typically net out the VAT they paid on purchases from the amount owed. To see how this works, consider an item that costs $100 at wholesale and is sold for $200 at retail. If VAT is charged at 10% throughout the chain, then the retailer pays $10 in VAT and charges $20 in VAT—therefore owing the difference of $10 to the government.

In practice, VAT evasion is one of the most common types of tax evasion. For instance, in the above example, a retailer might say that they sold the good for $120 rather than the $200 for which they actually sold it. In that case, the retailer would declare that they charge VAT of $12. Since they paid $10 in VAT when purchasing the item at wholesale, they would then only pay the government $2. The government thus effectively loses 40% of its potential VAT revenue (it receives a total of $12, rather than the $20 that it should have received).

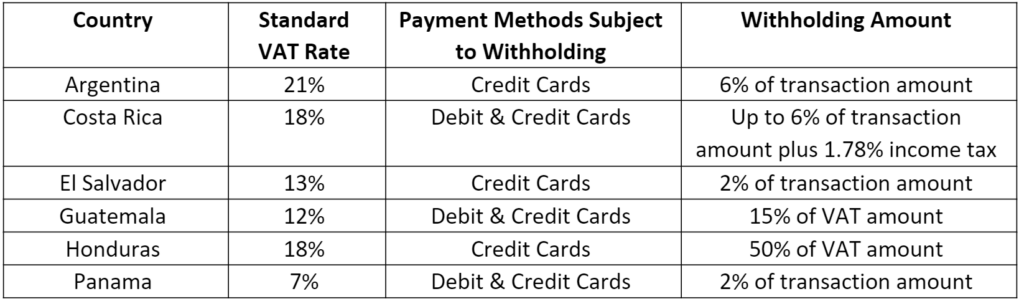

In an attempt to reduce these losses, many governments in Latin America have introduced “split payments,” whereby some or all of the liability for paying VAT on a particular transaction is shifted from the supplier to the recipient or—in some cases, such as when payment is made by card—to their agent, such as the payment-services provider (PSP), who becomes a VAT-withholding agent. Thus, the payment is “split,” with some going to the vendor and some going to the government (see Table 1).

Numerous jurisdictions have introduced withholding taxes on payments made by card, but have not introduced similar withholding taxes on other electronic-payment methods, such as the use of P2P systems. This creates a regulatory arbitrage opportunity and, consciously or not, favors the payment methods not subject to the withholding measures.

Table 1: Examples of VAT-Withholding Requirements for Payment-Service Providers in the Americas

Source: PWC

Source: PWC

Effects on Rule of Law, Good Governance, Business Efficiency, and the Informal Economy

While these “split payments” and associated withholdings are no doubt well-intentioned and may have reduced some losses associated with tax evasion and fraud, they have created incentives for other types of evasion and fraud, resulting in tax losses and other problems.

Specifically, by limiting withholding requirements to card payments (and—in some cases—only to credit cards), tax authorities are effectively providing merchants with incentives to give preference to other payment methods, including cash and P2P payments.

In Costa Rica, the proportion of retail transactions using the central bank’s P2P payment system, Sinpe Movil, has increased about 50-fold since 2019, leading to concerns that retailers are encouraging consumers to use Sinpe Movil to avoid paying or to underreport VAT on transactions. Indeed, the nation’s former minister of finance has raised such concerns.

This has three direct effects: First, it has the effect intended by the merchant and customer in choosing an alternative payment method, which is to reduce the amount of VAT that is paid.

Second, since both cash and P2P payments are final and not easily reversed, and since both merchants and customers would presumably want to limit documentation of the transaction in order to avoid liability for VAT, it has the effect of reducing the enforceability of agreements. (As my contracts professor quipped, a parol contract is worth the paper it is written on.)

Third, it creates an unlevel playing field for digital payments and their providers, undermining incentives to invest in innovation in the broader payments ecosystem and thereby delaying the shift to electronic payments more generally and reducing financial inclusion.

These effects are contrary to the rule of law and good governance. Simply by applying withholding taxes to one type of payment but not others, governments are engaging in discrimination, which is directly contrary to the rule of law. In addition, as noted, it likely weakens the enforceability of agreements. Finally, the consequent reduction in tax receipts means less can be spent by the government on the provision of legitimate public goods, such as law enforcement and tax administration.

Furthermore, by effectively encouraging merchants to avoid keeping proper records, the imposition of a requirement to withhold VAT only on card transactions undermines business efficiency. This is because, in principle, electronic payments make it easier for businesses to track income and expenditure and, by integrating payments systems with accounting and inventory-management software, merchants can simultaneously improve efficiency, ensure that they have in-demand items in stock, and reduce theft-related losses. But if businesses are misstating their sales in order to evade taxes, they will not be able to benefit from these integrations.

At the extreme, it discourages individuals and businesses from participating fully in the formal economy and instead encourages them to transact in the black market. This is truly a perverse outcome, given that one of the main goals of establishing interoperable P2P systems is to expand the formal sector and thereby enable businesses to access credit at lower cost, driving innovation, as well as enabling businesses to scale.

The Way Forward

Despite these blatant practices, and notwithstanding the concerns raised by Costa Rica’s former minister of finance, it appears the initiatives that tax authorities have undertaken in some jurisdictions are insufficient to address the issue. This amounts to tacit acceptance, bordering on encouragement of tax evasion, which is problematic not just from the perspective of lost revenues but also in terms of fairness and good governance.

The current situation presents something of a paradox: payment systems established by government entities—ostensibly to enable businesses to participate in the formal economy—may be used by those businesses as a means to evade the very taxes that the systems were introduced to crack down on the evasion of. They thereby actually reduce participation in the formal economy!

But there would seem to be some reasonably straightforward ways to escape this paradox:

First, governments could expand the application of withholding taxes to all payment methods, including P2P payments. In practice, it would be difficult to extend this requirement to cash (for instance, would some proportion of each cash withdrawal from a bank be subject to withholding?), in which case this solution would have the perverse effect of encouraging a partial switch to cash payments. Nonetheless, on net, this would be a significant improvement over the status quo.

Second, governments could scrap the withholding requirements currently imposed on payment-service providers and instead focus on reporting, monitoring, and enforcement. For example, those governments that have not already done so could implement the OECD’s e-auditing standards, including its Standard Audit File for Tax (SAFT) system. They could also implement real-time tax reporting, enabling tax authorities the ability to access (pull) tax records directly, rather than relying on merchants to send those records (push).

From the perspective of encouraging the switch to electronic payments, with all their benefits, the second approach is likely superior, since it would be largely neutral regarding the payment method (e.g., between cards and P2P systems) but would encourage merchants to implement integrated-payment processing, record keeping, and inventory-management systems (i.e., enterprise resource-planning systems) that improve business efficiency.

Regardless which approach is adopted, there might also be merits to taking steps to improve the incentives to pay VAT. One such step would be to reduce and simplify VAT rates, especially in jurisdictions with rates of more than 15%, since high VAT rates create strong incentives for evasion. To the extent that lower rates of VAT result in increased compliance and reduced expenditure on both enforcement and evasion, they may also generate higher net revenue to local treasuries.

However governments choose to address this issue, it is important that they avoid unfair and perverse distortions to payments systems. Beyond fixing the problems related to withholding taxes, that means ensuring regulations that affect the sector are fair and impartial, and being especially careful to avoid conflicts of interest. By so doing, governments can create a more nurturing environment for innovation and financial inclusion.