Everyone loves to hate record labels. For years, copyright-bashers have ranted about the “Big Labels” trying to thwart new models for distributing music in terms that would make JFK assassination conspiracy theorists blush. Now they’ve turned their sites on the pending merger between Universal Music Group and EMI, insisting the deal would be bad for consumers. There’s even a Senate Antitrust Subcommittee hearing tomorrow, led by Senator Herb “Big is Bad” Kohl.

But this is a merger users of Spotify, Apple’s iTunes and the wide range of other digital services ought to love. UMG has done more than any other label to support the growth of such services, cutting licensing deals with hundreds of distribution outlets—often well before other labels. Piracy has been a significant concern for the industry, and UMG seems to recognize that only “easy” can compete with “free.” The company has embraced the reality that music distribution paradigms are changing rapidly to keep up with consumer demand. So why are groups like Public Knowledge opposing the merger?

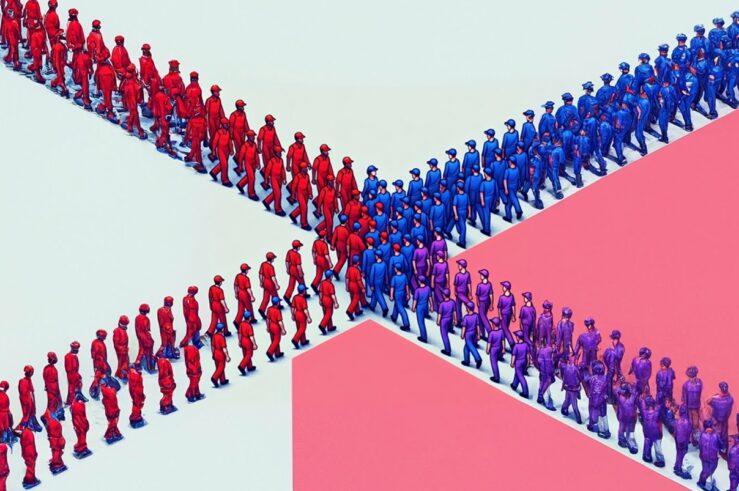

Critics contend that the merger will elevate UMG’s already substantial market share and “give it the power to distort or even determine the fate of digital distribution models.” For these critics, the only record labels that matter are the four majors, and four is simply better than three. But this assessment hews to the outmoded, “big is bad” structural analysis that has been consistently demolished by economists since the 1970s. Instead, the relevant touchstone for all merger analysis is whether the merger would give the merged firm a new incentive and ability to engage in anticompetitive conduct. But there’s nothing UMG can do with EMI’s catalogue under its control that it can’t do now. If anything, UMG’s ownership of EMI should accelerate the availability of digitally distributed music.

To see why this is so, consider what digital distributors—whether of the pay-as-you-go, iTunes type, or the all-you-can-eat, Spotify type—most want: Access to as much music as possible on terms on par with those of other distribution channels. For the all-you-can-eat distributors this is a sine qua non: their business models depend on being able to distribute as close as possible to all the music every potential customer could want. But given UMG’s current catalogue, it already has the ability, if it wanted to exercise it, to extract monopoly profits from these distributors, as they simply can’t offer a viable product without UMG’s catalogue.

The merger with EMI—the smallest of the four major labels, with a US market share of around 9%—does nothing to increase UMG’s incentive or ability to extract monopoly rents. UMG’s ability to raise prices on Lady Gaga’s music is hardly affected by the fact that it might also own Lady Antebellum’s music, anymore than its current ownership of Ladyhawke’s music does. But, regardless, UMG has viewed digital distribution as a friend, not a foe.

Even on their own, structural terms, the critics’ analysis is flawed. The argument against the merger is based largely on the notion that the critical, relevant antitrust market comprises album sales by the four major labels. But this makes no sense.

In fact, UMG currently distributes only about 30% of the music consumed in the US, and because, like all the majors, it distributes some music over which it has no ownership rights (including no ability to set prices), it owns only 24% of music purchased in the US. EMI’s share of distribution, as we noted, is around 9%, and it has experienced significant turmoil in recent years. Meanwhile, the independent labels that some critics seek to exclude from the market (and which, ironically, probably distribute the bulk of the music they listen to) sell 30% of the records sold in the US today and do so digitally largely through a single distributor, Merlin—essentially a fifth major record label. This is far beyond trivial.

What matters for antitrust market definition is substitutability: If customers would purchase eight singles off an album in response to an increase in the 12-track album price, singles and albums are surely in the same market. Ditto consumption of singles and entire albums through streaming services in lieu of outright purchase—and it’s clear that this mode of distribution is increasingly popular. There is no principled defense of an album-only market, nor one that excludes independent labels or streaming services. And once you appreciate these market dynamics, the concerns over this merger disappear.

The reality is closer to this: EMI is effectively a failing firm. Its current owner (Citigroup) inherited the company when its previous owner defaulted, and it promptly put it up for auction. Warner and UMG both bid on EMI and UMG won. Now Warner leads the effort to stymie the deal, deploying a time-tested strategy of trying to accomplish by regulation what it couldn’t manage through genuine competition.

Everyone loves to hate record labels. For years, copyright-bashers have ranted about the “Big Labels” trying to thwart new models for distributing music in terms that would make JFK assassination conspiracy theorists blush. Now they’ve turned their sites on the pending merger between Universal Music Group and EMI, insisting the deal would be bad for consumers. There’s even a Senate Antitrust Subcommittee hearing tomorrow, led by Senator Herb “Big is Bad” Kohl.

But this is a merger users of Spotify, Apple’s iTunes and the wide range of other digital services ought to love. UMG has done more than any other label to support the growth of such services, cutting licensing deals with hundreds of distribution outlets—often well before other labels. Piracy has been a significant concern for the industry, and UMG seems to recognize that only “easy” can compete with “free.” The company has embraced the reality that music distribution paradigms are changing rapidly to keep up with consumer demand. So why are groups like Public Knowledge opposing the merger?

Critics worry that a larger UMG will stifle innovative distribution services. While that’s theoretically possible, UMG’s past practice and the industry’s changing dynamics—including the significant increase in buyer power from large retailers like Apple, Amazon and Wal-Mart—suggest the concern is speculative, at best. Albums are simply not the dominant marketing vehicles they once were for most artists, and, increasingly, consumers are content to “rent” their music through streaming and other online services rather than own it outright.

A slightly larger UMG poses no threat to the evolving distribution of music. In fact, UMG has increasingly championed digital distribution as it has grown in size. UMG’s history with digital distribution should please anyone concerned about the deal: it has been both aggressive and progressive in the digital space. UMG is often the first to license its catalogue to new services and it has financially supported the creation of some of the largest of these services. When online giant Slacker Radio added a subscription service to its Web radio offering, UMG not only licensed its catalogue for the new service but also renegotiated (and lowered) its terms for Slacker’s webcasting license in order to ease Slacker’s move into subscription services. And UMG was instrumental in getting Muve—the second largest subscription music service in the US today—off the ground. Again—the industry’s best defense against “free” is “easy,” and that doesn’t change for UMG if it gains another few percentage points of market share.

To paraphrase Timbuk 3 (from an album originally released on the famed I.R.S. label): Music’s future is so bright, it’s gotta wear shades. Music has never been cheaper, easier to access, more widely distributed, nor available in more forms and formats. And the digital distribution of music—significantly facilitated by UMG—shows no signs of slowing down. What has slowed down, thanks largely to these advances in digital and online distribution, is music piracy. Anyone looking for an explanation why UMG has been so progressive in its support for innovation in music distribution need look no further than that fact. This merger does nothing to change UMG’s critical incentives to continue to support digital distribution of its catalogue: fighting piracy and effectively distributing its music.

[Cross posted at Forbes.com]