Germán Gutiérrez and Thomas Philippon have released a major rewrite of their paper comparing the U.S. and EU competitive environments.

Although the NBER website provides an enticing title — “How European Markets Became Free: A Study of Institutional Drift” — the paper itself has a much more yawn-inducing title: “How EU Markets Became More Competitive Than US Markets: A Study of Institutional Drift.”

Having already critiqued the original paper at length (here and here), I wouldn’t normally take much interest in the do-over. However, in a recent episode of Tyler Cowen’s podcast, Jason Furman gave a shout out to Philippon’s work on increasing concentration. So, I thought it might be worth a review.

As with the original, the paper begins with a conclusion: The EU appears to be more competitive than the U.S. The authors then concoct a theory to explain their conclusion. The theory’s a bit janky, but it goes something like this:

- Because of lobbying pressure and regulatory capture, an individual country will enforce competition policy at a suboptimal level.

- Because of competing interests among different countries, a “supra-national” body will be more independent and better able to foster pro-competitive policies and to engage in more vigorous enforcement of competition policy.

- The EU’s supra-national body and its Directorate-General for Competition is more independent than the U.S. Department of Justice and Federal Trade Commission.

- Therefore, their model explains why the EU is more competitive than the U.S. Q.E.D.

If you’re looking for what this has to do with “institutional drift,” don’t bother. The term only shows up in the title.

The original paper provided evidence from 12 separate “markets,” that they say demonstrated their conclusion about EU vs. U.S. competitiveness. These weren’t really “markets” in the competition policy sense, they were just broad industry categories, such as health, information, trade, and professional services (actually “other business sector services”).

As pointed out in one of my earlier critiques, In all but one of these industries, the 8-firm concentration ratios for the U.S. and the EU are below 40 percent and the HHI measures reported in the original paper are at levels that most observers would presume to be competitive.

Sending their original markets to drift in the appendices, Gutiérrez and Philippon’s revised paper focuses its attention on two markets — telecommunications and airlines — to highlight their claims that EU markets are more competitive than the U.S. First, telecoms:

To be more concrete, consider the Telecom industry and the entry of the French Telecom company Free Mobile. Until 2011, the French mobile industry was an oligopoly with three large historical incumbents and weak competition. … Free obtained its 4G license in 2011 and entered the market with a plan of unlimited talk, messaging and data for €20. Within six months, the incumbents Orange, SFR and Bouygues had reacted by launching their own discount brands and by offering €20 contracts as well. … The relative price decline was 40%: France went from being 15% more expensive than the US [in 2011] to being 25% cheaper in about two years [in 2013].

While this is an interesting story about how entry can increase competition, the story of a single firm entering a market in a single country is hardly evidence that the EU as a whole is more competitive than the U.S.

What Gutiérrez and Philippon don’t report is that from 2013 to 2019, prices declined by 12% in the U.S. and only 8% in France. In the EU as a whole, prices decreased by only 5% over the years 2013-2019.

Gutiérrez and Philippon’s passenger airline story is even weaker. Because airline prices don’t fit their narrative, they argue that increasing airline profits are evidence that the U.S. is less competitive than the EU.

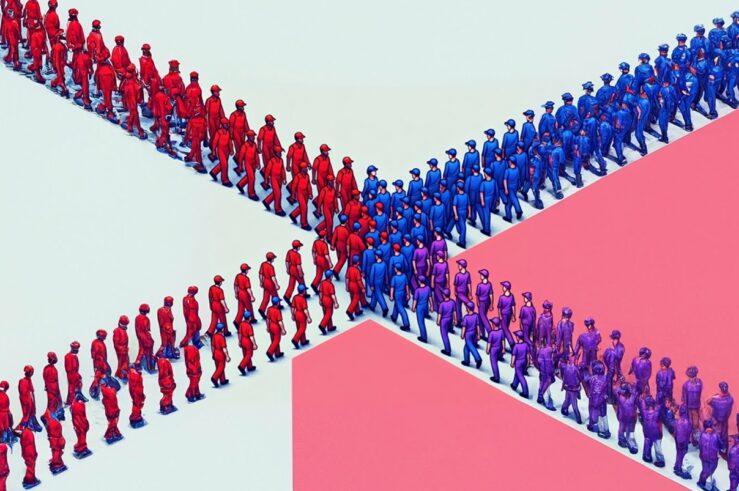

The picture above is from Figure 5 of their paper (“Air Transportation Profits and Concentration, EU vs US”). They claim that the “rise in US concentration and profits aligns closely with a controversial merger wave,” with the vertical line in the figure marking the Delta-Northwest merger.

Sure, profitability among U.S. firms increased. But, before the “merger wave,” profits were negative. Perhaps predatory pricing is pro-competitive after all.

Where Gutiérrez and Philippon really fumble is with airline pricing. Since the merger wave that pulled the U.S. airline industry out of insolvency, ticket prices (as measured by the Consumer Price Index), have decreased by 6%. In France, prices increased by 4% and in the EU, prices increased by 30%.

The paper relies more heavily on eyeballing graphs than statistical analysis, but something about Table 2 caught my attention — the R-squared statistics. First, they’re all over the place. But, look at column (1): A perfect 1.00 R-squared. Could it be that Gutiérrez and Philippon’s statistical model has (almost) as many parameters as variables?

Notice that all the regressions with an R-squared of 0.9 or higher include country fixed effects. The two regressions with R-squareds of 0.95 and 0.96 also include country-industry fixed effects. It’s very possible that the regressions results are driven entirely by idiosyncratic differences among countries and industries.

Gutiérrez and Philippon provide no interpretation for their results in Table 2, but it seems to work like this, using column (1): A 10% increase in the 4-firm concentration ratio (which is different from a 10 percentage point increase), would be associated with a 1.8% increase in prices four years later. So, an increase in CR4 from 20% to 22% (or an increase from 60% to 66%) would be associated with a 1.8% increase in prices over four years, or about 0.4% a year. On the one hand, I just don’t buy it. On the other hand, the effect is so small that it seems economically insignificant.

I’m sure Gutiérrez and Philippon have put a lot of time into this paper and its revision. But there’s an old saying that the best thing about banging your head against the wall is that it feels so good when it stops. Perhaps, it’s time to stop with this paper and let it “drift” into obscurity.