When it was passed into law, the European Union’s Digital Markets Act (DMA) was heralded by supporters as a key step toward fairness and contestability in online markets. It has unfortunately become increasingly clear that reality might not live up to those expectations. Indeed, there is mounting evidence that European consumers’ online experiences have been degraded following the DMA’s entry into force.

The perception that the DMA has been a failure is beginning to motivate a not insignificant amount of finger pointing in Brussels. So-called “gatekeeper” firms have blamed heavy-handed regulation for their degraded services, while smaller rivals finger “malicious compliance.”

Not keen to remain on the sidelines, the European Commission recently went on the offensive, opening no fewer than five noncompliance investigations against Apple, Meta, and Alphabet—with two more cases in the pipeline. In doing so, it served to dispel the once-common belief that the DMA would be “self-executing” and that enforcement would be collaborative, rather than adversarial.

This will have important consequences for Europe’s online markets. This first wave of DMA enforcement actions is largely a repeat of existing competition-law cases, albeit with most of the procedural and substantive safeguards removed. The Commission is also cutting an increasingly hawkish figure, seemingly giving gatekeepers very little leeway in how they seek to comply with the DMA.

As explained below, this will increasingly lead platforms to play it safe by removing certain contested features from the services they offer in Europe, as well as relying on litigation to assert their rights. Neither of those outcomes are in the interest of European consumers.

All Roads Lead to Luxembourg

The DMA was designed both to be self-executing and to foster a more collaborative form of enforcement. The idea was to avoid the protracted litigation that has come to be associated with European competition-law cases.

The DMA required gatekeeper firms—Apple, Amazon, Alphabet, ByteDance, Meta, and Microsoft—to prepare compliance plans and share them with the Commission and stakeholders by March 7, 2024. This was to be followed by a series of workshops where gatekeepers could discuss these plans with stakeholders.

These proceedings presumably aimed to reduce the litigation typically required for enforcement, thereby also achieving faster compliance (because litigation is an inherently lengthy process, especially before European courts). Unfortunately, it is increasingly clear this is not how things are going to pan out.

A day before the final workshop, the Commission launched several noncompliance investigations against Apple, Meta and Alphabet. Though these are officially only “investigations,” it appears highly unlikely that the Commission will ultimately conclude that the gatekeepers were compliant, after all.

In the related field of European competition law, investigations almost invariably lead to infringement decisions—especially in tech markets. And given the statements issued by both European Commissioner for Internal Market Thierry Breton and European Commissioner for Competition Margrethe Vestager when the investigations were launched, there is little reason to believe things will be any different in this case. Breton notably observed that:

These are the cases where we already have concrete evidence of possible non-compliance. And this in less than 20 days of DMA implementation.

Unless the Commission approaches these investigations with an uncharacteristically open mind, the road to DMA compliance will almost certainly have to go through the European Court of Justice in Luxembourg. If so, resolution will take years, not months, to achieve—precisely what the DMA sought to avoid.

Nostalgia for Competition Enforcement

A second and more troubling feature of the Commission’s investigations is that they are essentially extensions of ongoing or already-closed competition cases—albeit under a new regulatory framework that provides far fewer substantive and procedural safeguards.

This is problematic, because those cases raised important tradeoffs that require careful consideration. This will be impossible under the DMA, as the regulation precludes any analysis of effects on consumers or countervailing efficiencies.

In short, the DMA requires enforcers to analyze these complex tradeoffs—as evidenced in the related competition cases I discuss below—without the tools needed to do so. This may result in suboptimal outcomes for consumers.

Google Search

The problems are nowhere clearer than in the Commission’s investigation of Google’s preferential treatment of its own services (such as Flights, Maps, and Hotels).

The Court of Justice in Luxembourg is currently considering a nearly identical case brought under competition rules that concerns the Google Shopping service. That case raises complex tradeoffs among encouraging investment in Google’s services, ensuring those services function for consumers, and ensuring that rivals are free to compete. Unfortunately, these tradeoffs do not magically disappear under the DMA.

The risk is that the DMA will degrade the Google search engine while providing no meaningful benefits to competition. European users can no longer click on map locations in Google Search, because this could amount to prohibited self-preferencing. The DMA has also resulted in lower traffic to hotel websites.

On the other side of the equation, it is unclear that the DMA will meaningfully boost competition. Remedies in the Google Shopping case did not enable rivals to offer compelling alternatives to Google’s services—most likely because they lack the ability to efficiently market such services. There is little indication that Google’s rivals in the maps and booking (flights and hotels) segments will fare any better.

Apple iOS

Another example concerns Apple’s web-browser choice screen on iOS. The Commission appears to be upset that consumers are not required to walk through all 12 browser offerings presented on that screen.

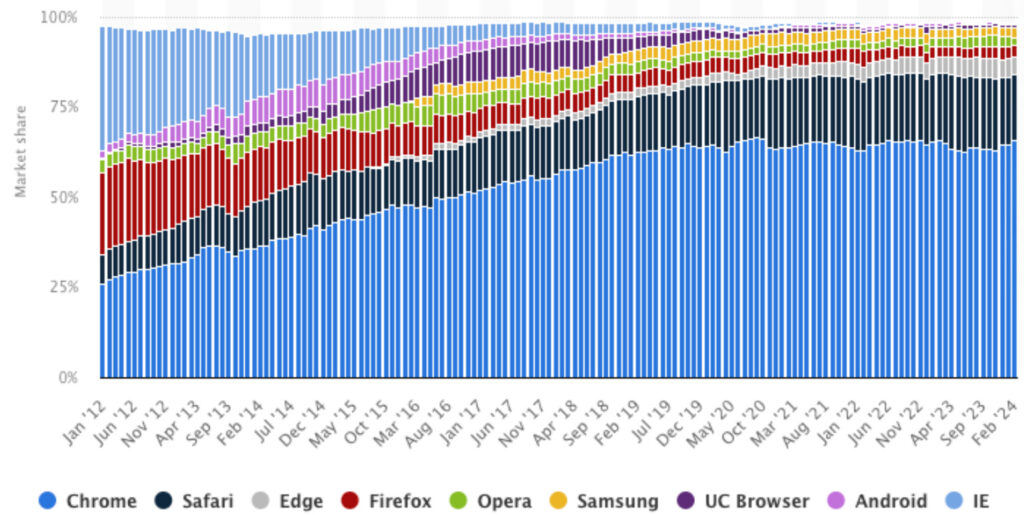

The Commission’s focus on this minor issue would not be so problematic if choice-screen remedies have not repeatedly failed when they’ve been tried in the past. Indeed, competition enforcement against Microsoft resulted in a mandated browser choice screen that was so ineffective, it took months for anyone to notice when Microsoft “accidentally” discontinued it. A similar choice screen presented to Google Android users in Europe has failed to meaningfully alter market shares for web browsers (source: Statista):

Proponents sometimes argue that those browser choice screens were poorly designed and enforced. But the alternate explanation is more compelling: consumers were always free to choose the browser they preferred, even absent choice screens. Internet Explorer started to decline well before competition enforcement. And the market share of the Chrome browser has remained steady, despite the introduction of a choice screen.

If this is true, then spending years haggling over the design of Apple’s choice screen is a waste of limited enforcement resources.

Meta

There are similar issues in the Commission’s investigation of Meta. Article 5.2 of the DMA provides that gatekeepers must obtain users’ consent to use their data across different services (including to target ads). To comply with this requirement, Meta introduced an ad-free subscription for European users, who can now choose between free services with targeted ads or a paid subscription with no ads.

But the Commission argues that this choice does not constitute “freely given” consent under the DMA, because users must pay to avoid targeted ads. Unfortunately for the Commission, the Court of Justice ruled recently (in a competition case involving Meta) that paid tiers were compatible with freely given consent. Meta’s solution falls squarely within this ruling, which by extension also applies to the DMA.

The Commission is thus attempting to relitigate the same case in hopes that Meta will fold or that the judges in Luxembourg will somehow change their minds. Put differently, it is attempting to impose its preferred product design on Meta, regardless what the underlying case law says.

Steering Investigations

Much the same can be said about the Commission’s investigations into Apple and Alphabet’s anti-steering rules (i.e., conduct whereby firms discourage or prevent consumers from purchasing goods or services outside their platforms). This conduct has recently been addressed under European competition law, with the Commission closing a case against Apple in early March.

Which raises the question: why is the Commission opening a new investigation into conduct it ruled against mere weeks before? The likely explanation is that the Commission fears that Apple will appeal its decision, and sees the DMA as firmer grounds on which to rest its case.

While this is certainly a viable enforcement strategy, it paints an unflattering picture of the DMA: namely, that of a tool used to replace competition enforcement in cases where consumer harm is absent or too difficult to prove.

Where Do We Go from Here?

The Commission appears to have adopted Alexander the Great’s strategy toward the Gordian Knot. It is using brute (regulatory) force to (re)litigate old competition cases. Unfortunately, the reasons that those competition cases were hard to bring or failed to deliver the anticipated benefits have not disappeared under the DMA—they are merely being swept under the rug.

The Commission is also setting an unfortunate precedent for DMA enforcement. By taking a confrontational stance and affording platforms little leeway in how they comply with the DMA, the Commission is effectively signaling that hard-fought litigation is the only way for platforms to assert their rights. The Commission may come to regret this, as the cases start mounting and its enforcement resources are stretched ever thinner.

This is also bad news for European consumers. As these legal risks mount, tech companies may increasingly degrade or scale back their services in Europe (as evidenced by Google’s temporary closure of vertical services and Meta’s delayed introduction of services in Europe). Firms may also be forced to cut corners when it comes to protecting Europeans’ online safety. For users, this will mean reduced convenience and safety in the name of hypothetically increased future competition. The new regulatory regime could also penalize third parties that rely on gatekeeper platforms—reduced Google Search functionality has already translated into fewer clicks for flight, hotel, and restaurant websites in Europe.

Luckily, there is still time for the Commission to change course. By keeping an open mind during its investigations, it could ensure that defendants and stakeholders remain at the bargaining table and seek reasonable solutions that work for everyone, including consumers.

For this to happen, the Commission first needs to acknowledge that product-design choices involve significant tradeoffs that can impact entire ecosystems of consumers and third parties. Gatekeepers should have some say as to how these tradeoffs are resolved.

Ultimately, the Commission faces a choice: to embody the uncompromising approach of Judge Dredd or the deliberative stance of Juror 8 from “12 Angry Men.” One hopes it will opt for the latter.