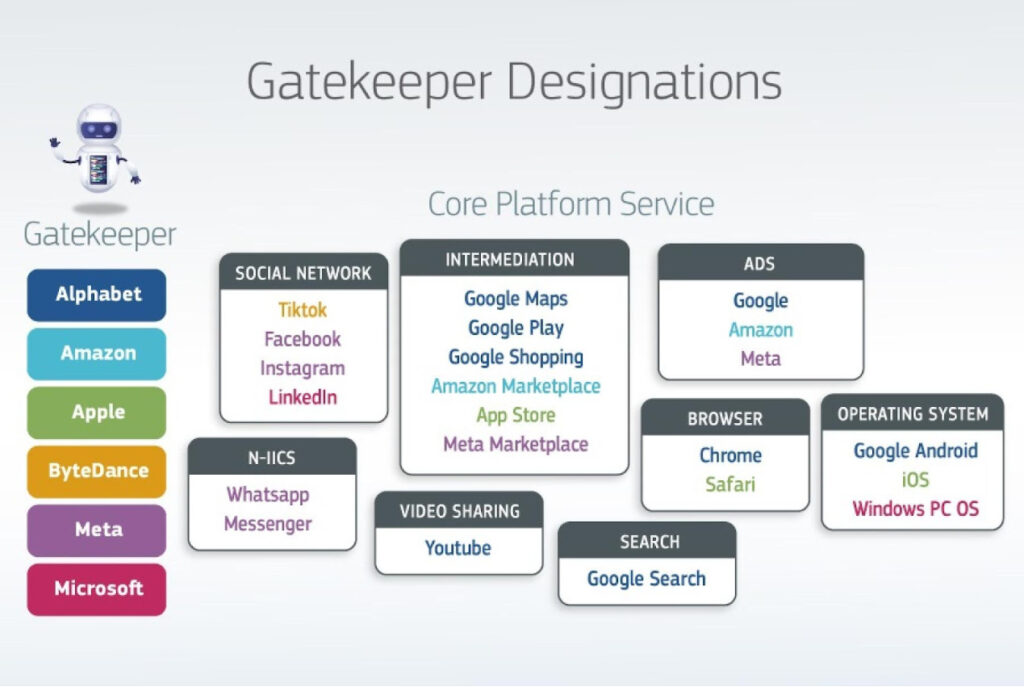

The European Commission late last month published the full list of its “gatekeeper” designations under the Digital Markets Act (DMA). Alphabet, Amazon, Apple, ByteDance, Meta, and Microsoft—the six designated gatekeepers—now have six months to comply with the DMA’s list of obligations and restrictions with respect to their core platform services (CPS), or they stand to face hefty fines and onerous remedies (see here and here for our initial reactions).

While it is important to know who the gatekeepers are, the more fundamental question is why they were designated. In this post, I argue that neither the Commission’s designation decisions nor the DMA itself answer this question in a cogent, economically grounded way. To understand what makes a company a “gatekeeper,” one must look beyond the DMA’s shallow designation criteria; the law’s vague, self-professed goals of “fairness and contestability”; and the text of the Commission’s decisions. What emerges instead is a story of wealth redistribution, protectionism, and state power that heralds a new approach to competition regulation.

The Lofty Theory Behind Gatekeeping

The DMA rests on the premise that the core platform services operated by the so-called “Big Tech” firms are unlike any others, and thus necessitate special regulation. The theory is that incumbent digital platforms benefit from a set of advantages that include extreme economies of scale; zero or near-zero marginal costs; user lock-in; network effects; and first-mover advantages, such as access to a critical mass of key inputs (data). These advantages purportedly create high entry barriers and make markets prone to tipping.

Due to the immense popularity and convenience of the digital platforms’ core services, the companies that control these platforms, in practice, also control access to customers, other businesses, and markets, and are thereby able to dictate the terms of the relationship between buyers and sellers. Ultimately, this allows them to entrench their dominance by fending off competitors, to leverage their position in one market to enter or expand into adjacent markets—even if their products are objectively worse—and to capture the lion’s share of supply-chain value (see here and here).

According to the DMA, these effects cannot be addressed through conventional EU competition-law tools, because they are either not germane to a consumer-welfare based analysis (the type of harm caused is not to competition or consumers), or because they operate below the threshold at which competition law typically considers conduct to be anticompetitive, and at which it allows competition authorities to intercede on behalf of the public interest (see here and here).

This position is backed by several reports. For example, the OECD has noted that “competition frameworks designed for traditional products may not be suitable for a global digital economy.” A 2019 report from the German Federal Ministry for Economic Affairs and Energy earlier found that “despite certain parallels to the conventional network industries, the digital economy is different” and that competition rules are “not always sufficient in order to respond to emerging trends towards a concentration of power.”

Some observers have also called for—and subsequently welcomed—the DMA or DMA-style ex-ante regulation, hailing it as an “obvious” necessity and a step in the right direction to keep pace with developments in those markets that have presented difficulties for traditional competition policy (here and here). It has even been said that antitrust law is just “too slow and too piecemeal…and too conservative” to deal with the global challenge that Big Tech platforms present (here). Regulatory and scholarly anxieties about the unique and imminent threat posed by Big Tech have, in turn, become ingrained in the zeitgeist (here and here).

The Underwhelming Tests of ‘Gatekeeping’

For all its theoretical and rhetorical appeal, the DMA is surprisingly thin on the substantive test of gatekeeper status.

The law offers essentially two ways to ascertain whether a company is a gatekeeper. Under the first, the Commission takes into account such factors as a company’s size, position, structure (whether it is vertically integrated, whether it is in a position to cross-subsidize its products, etc.), the presence of economies of scale and scope, and user lock-in. Alternatively, a company is presumed to be a gatekeeper when it fulfills a series of quantitative thresholds related to turnover and number of users.

The rigid, per se nature of these tests is reflected in the Commission’s recent designation decisions, which largely turn on whether a certain product or service is part of a CPS (and thus subject to the DMA), and whether the DMA’s quantitative thresholds have been met (see, e.g., here and here). The DMA’s drafters made a deliberate attempt to leave little leeway for companies to dispute a gatekeeper presumption and thereby “hamper the DMA’s effectiveness.”

The issue, however, is that neither the quantitative nor the qualitative criteria outlined in the DMA are obvious indicators of gatekeeper power. Many companies have high turnover and a broad customer base. Many more are “big,” vertically integrated, able or willing to cross-subsidize their products, benefit from economies of scale or scope, and have loyal customers unwilling to switch because they may or may not be “locked in.” In 2023, almost any company established in virtually any industry has “data-driven” advantages about clients, competitors and products. Companies active in sectors as diverse as retail, insurance, banking, financial services, media, or software all present some or all of the above characteristics.

Of course, what supposedly distinguishes gatekeepers is that they operate core platform services in which these traits are compounded in ways that present special challenges. But, again, this premise rests on two questionable assumptions:

- That CPSs are different from other products or services and;

- That CPSs are sufficiently similar to be considered (and regulated) as a group.

The former would be more convincing if the remedies the DMA contemplates—such as mandating interoperability and opportunities for sideloading, and banning bundling and “most favored nation” agreements—had not been previously used in other markets and for other products (see, for example, here). The fact that the list of CPSs (or equivalent) in other countries differs from the DMA’s also belies the notion that CPSs present universal sui generis characteristics that justify targeted regulation.

In addition, neither the core platform services, the companies that operate them, nor the business models they employ are monolithic. Voice assistants and social media, for instance, are vastly different products. The same can be said about cloud computing, which is not really a “platform” in the sense that, say, online intermediation is. The CPSs themselves are also highly heterogeneous, with a single category encompassing a motley list of products, from e-commerce to online maps and app stores.

The same argument applies to gatekeepers, which—despite the ubiquitous “Big Tech” moniker—are ultimately very different firms (here and here). As Apple CEO Tim Cook has said:

Tech is not monolithic. That would be like saying “All restaurants are the same” or “All TV networks are the same.”

For instance, while Google (Alphabet) and Facebook (Meta) are information-technology firms that specialize in online advertising, Apple remains primarily an electronics company, with around 75% of its revenue coming from the sale of iMacs, iPhones, iPads, and accessories. As Amanda Lotz of the University of Michigan has observed:

The profits on those [hardware] sales let Apple use very different strategies than the non-hardware [“Big Tech”] companies with which it is often compared.

It also means that most of its other businesses—such as iMessage, iTunes, Apple Pay, etc.—are complements that “Apple uses strategically to support its primary focus as a hardware company.” Amazon, on the other hand, is primarily a retailer, with its Amazon Web Services and advertising divisions accounting for 15% and 7% of the company’s revenue, respectively (here).

Even when two “gatekeepers” are active in the same CPS, they often have markedly different business models and practices. Thus, despite both selling mobile-phone operating systems, Android (Google) and Apple employ nearly opposite product-design philosophies. As the International Center for Law & Economics (ICLE) argued in an amicus curiae brief submitted last month to the U.S. Supreme Court in Apple v. Epic Games:

For Apple and its users, the touchstone of a good platform is not “openness,” but carefully curated selection and security, understood broadly as encompassing the removal of objectionable content, protection of privacy, and protection from “social engineering,” and the like. … By contrast, Android’s bet is on the open platform model, which sacrifices some degree of security for the greater variety and customization associated with more open distribution. These are legitimate differences in product design and business philosophy.

These various companies and markets have diverse incentives, strategies, and product designs, therefore belying the idea that there is any economically and technically coherent notion of what comprises “gatekeeping.” It suggests instead that something else may be at play.

Wealth Redistribution, Protectionism, State Power, and a New Political Philosophy of Competition

If we accept the argument that gatekeepers and their core platform services do not share any—or do not have sufficient—inherent economic or technical peculiarities to justify a special regulatory regime, the question becomes whether there is any unifying principle behind the DMA’s gatekeeper-designation criteria. As is increasingly the case in the competition (or competition-adjacent) world, politics offers a better explanation than law, economics, or the market trend toward digitalization (see also here and here).

In a nutshell, the reason why the notion of gatekeeping appears so contrived from an economic, legal, and technical perspective is because the DMA’s economic, legal, and technical arguments were reverse engineered to apply to a set of predetermined firms that have little in common beyond being, for the most part, U.S.-based, technologically intensive, and vastly resourceful. Another thing they share is having used innovative business models to disrupt traditional industries—in the process, capturing massive rents and attracting millions of users. In other words, they are the world’s most successful “tech” companies (here).

Officially, the DMA has two goals: “fairness,” and “contestability.” Unofficially, however, the DMA was primarily crafted to achieve four outcomes:

- To redistribute rents across the supply chain from operators of digital platforms to their business users and complementors;

- To facilitate the growth of EU digital platforms to contest U.S. Big Tech’s leadership;

- To control and punish U.S. tech firms; and

- To launch a broader shift in the philosophy that underpins competition regulation.

Since Europe has no significant digital platforms (except, arguably, Booking.com and Spotify), the relationship of most European companies to gatekeepers is one of (self-imposed) dependency; acting primarily as business users or complementors. One of the DMA’s key goals is thus to redistribute value away from the platforms to their business users. In simple terms: to make it cheaper for business users to operate on those platforms (here and here). Several antitrust cases—such as the Dutch in-app payment-fees case against Apple (meant to help app developers operating on the App Store) and the Italian self-preferencing case against Amazon (meant to help distributors operating on Amazon.com)—are likely part of that same overarching strategy.

At the same time, however, the DMA’s prohibitions and obligations—such as self-preferencing, interoperability, data sharing, etc.—clearly indicate that the regime also aims to facilitate entry by rivals into the markets currently dominated by Alphabet, Amazon, Apple, Meta, and Microsoft (whether or not it will succeed is a different question). Prior to the DMA’s adoption, many leading European politicians were touting the text as a protectionist industrial-policy tool that would hinder U.S. firms to the benefit of European rivals (here and here).

This logic dovetails neatly with the EU’s broader push for “technology sovereignty,” a strategy intended to reduce the continent’s dependence on technologies that originate abroad (even if that means stifling the companies from its biggest ally: the United states). This strategy has already been institutionalized at different levels of EU digital and industrial policy (see here and here). In fact, the European Parliament’s 2020 Briefing on “Digital Sovereignty for Europe” explicitly anticipated an ex ante regulatory regime similar to the DMA as a central piece of that puzzle.

French President Emmanuel Macron summarized it well when he said:

If we want technological sovereignty, we’ll have to adapt our competition law, which has perhaps been too much focused solely on the consumer and not enough on defending European champions.

Relatedly, the DMA is also an exercise in discipline and control. With the vast powers it affords the Commission and its highly prescriptive nature, the law offers the EU a way to reassert its dominance over the U.S. Big Tech firms by bringing them to heel. The motivation is twofold. The first, as stated above, is that the EU has few important tech companies of its own, so the strategy has shifted to controlling those that arise elsewhere. The second is a growing desire to bolster the power of the state over private enterprise—something which, as I argue below, forms part of a broader trend in political philosophy.

The third goal is likely populist in nature: Alphabet, Amazon, Apple, Meta, and Microsoft are increasingly seen as out-of-control, conceited, and omnipresent, and the EU could ostensibly curry favor with its citizens if it were seen as “standing up to Big Tech.”

The DMA’s fourth goal is to pivot away from the normative framework that has informed EU competition law for the past two or three decades. Some authors have already warned that the DMA heralds a sea change in the underlying logic of competition regulation. According to Giuseppe Colangelo:

The [DMA] can be described as a sector-specific competition law, or a shift toward a more regulatory approach to competition law—one that is designed to allow assessments to be made more quickly and through a more simplified process.

Thibault Schrepel has argued that antitrust is on the verge of being redefined by the “great power competition” between EU, United States, China, and Russia. As a result, he predicts that antitrust law will become much more amenable to political and geopolitical interests, and to prioritize planning over competition.

In my view, these changes can also be understood as part of a broader reassessment of the social arrangement underpinning most Western democracies. “right neoliberalism,” as I have called it elsewhere, is a political philosophy that seeks the piecemeal improvement of classical liberalism through a more robust legal and institutional framework that operates primarily in the service of a single goal: economic efficiency and freedom understood as non-interference. The system is overseen by a powerful public enforcer, albeit one whose discretion is narrowly circumscribed, and generally defers to markets when evaluating economic outcomes and wealth distribution. In EU competition law, it is epitomized by the More Economic Approach (MEA) and the use of “consumer welfare” as the system’s lodestar.

For years, however, calls for a return to what I call “left neoliberalism” had been mounting in Europe. In a nutshell, left neoliberalism is about “embedding” markets into society and enshrining the state as the ultimate ordering power of the economy.

As I have written:

Left neoliberals and American progressives took Marxist and fascist attacks on liberalism seriously, but sought to address them through less radical channels. They wanted a “mostly liberal” third-way social order, in which markets and competition would be tempered by a host of other social and political considerations that were mediated by the state. This meant opposing “big business” as a matter of principle, infusing antitrust law with a host of non-economic goals and values, and granting enforcers the necessary discretion to decide in cases of conflict.

Today, dissatisfaction with right neoliberalism has become palpable. Across the political spectrum, authors castigate it as “market fundamentalism” (here and here). Academics scorn it as anti-democratic, elitist, and inhumane (here and here). The idea that markets are toxic, unfair, and rigged has also become prevalent through cultural osmosis—and enjoys more popular appeal than it has in decades (here and here).

The Commission, which had remained largely impervious to these critiques in the first decade of the 2000s, has recently started adopting some of the slogans of “left neoliberalism,” such as fairness, pluralism of goals, and the notion that competition is not about rivalry or discovery, but about inclusivity and “deconcentrated markets.” The Commission’s recent Guidance Paper on Article 102 TFEU Enforcement Priorities, for instance, puts forward interpretations of the European Courts’ case law that enhance the Commission’s powers, lower the burden of proof for intervening, and obfuscate the difference between efficient and inefficient market exit (thus suggesting that any elimination of a small or incipient competitor can amount to anticompetitive conduct).

The DMA, too, endows the Commission with vast powers to reshape markets and redesign products, without ever having to prove harm. It also implies a shift in the understanding of the role of competition regulation (and thus, also, of competition itself) in society. Rather than demarcating anticompetitive behavior from efficient (competitive) conduct, the emphasis is now on facilitating rivals and achieving certain overarching public-policy goals, even if they come at the expense of competitive business conduct that results from voluntary transactions among trading partners.

Conclusion

The DMA is—and was always intended to be—an expression of politics. Its genesis does not lie in technical breakthroughs that identified novel problems unique to so-called “core platform services,” or that were irresolvable through existing tools. Rather, what accounts for the DMA—and for what constitutes a “gatekeeper”—is the political will to redistribute rents away from companies that had become politically unpopular; to engage in protectionism; and to reassert state power over private power. Altogether, it simply marks the slow eclipse of one political philosophy of competition by another one.

In other words, when it comes to the DMA and gatekeepers, the causality is reversed: the DMA was not passed because gatekeepers exist. Rather, the very notion of “gatekeepers” exists because there is a DMA—because the Commission decided it wanted to regulate certain companies and reverse-engineered a justification to do so.