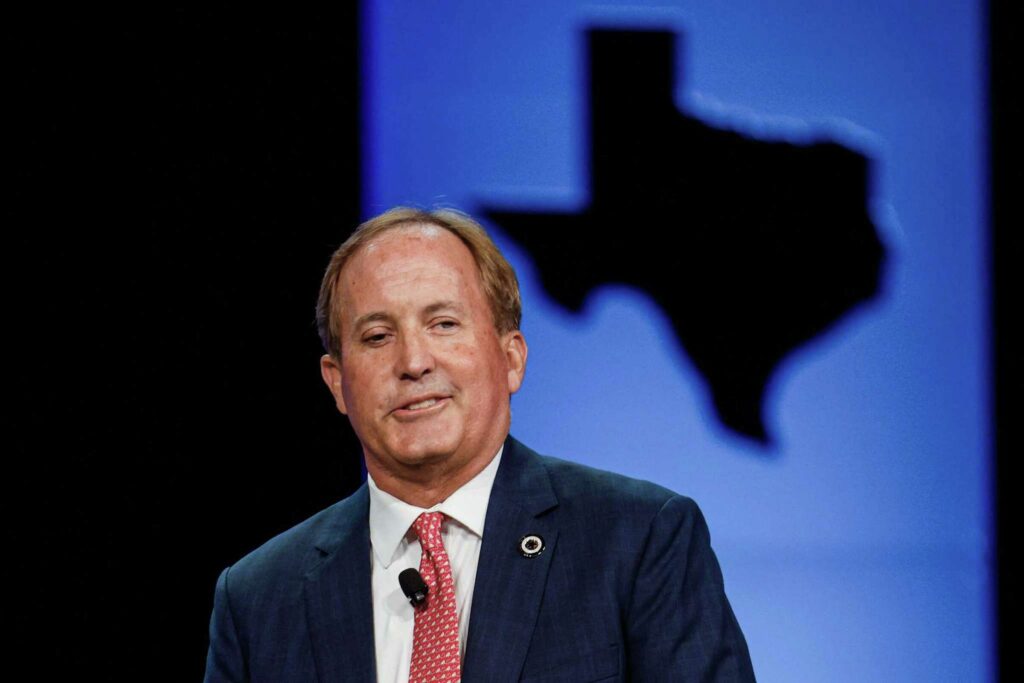

Having just comfortably secured re-election to a third term, embattled Texas Attorney General Ken Paxton is likely to want to change the subject from investigations of his own conduct to a topic where he feels on much firmer ground: the 16-state lawsuit he currently leads accusing Google of monopolizing a segment of the digital advertising business.

The segment in question concerns the systems used to buy and sell display ads shown on third-party websites, such as The New York Times or Runner’s World. Paxton’s suit, originally filed in December 2020, alleges that digital advertising is dominated by a few large firms and that this stifles competition and generates enormous profits for companies like Google at the expense of advertisers, publishers, and consumers.

On the surface, the digital advertising business appears straightforward: Publishers sell space on their sites and advertisers buy that space to display ads. In this simple view, advertisers seek to minimize how much they pay for ads and publishers seek to maximize their revenues from selling ads.

The reality is much more complex. Rather than paying for how many “eyeballs” see an ad, digital advertisers generally pay only for the ads that consumers click on. Moreover, many digital advertising transactions move through a “stack” of intermediary services to link buyers and sellers, including “exchanges” that run real-time auctions matching bids from advertisers and publishers.

Because revenues are generated only when an ad is clicked on, advertisers, publishers, and exchange operators have an incentive to maximize the likelihood that a consumer will click. A cheap ad is worthless if the viewer doesn’t act on it and an expensive ad may be worthwhile if it elicits a click. The role of a company running the exchange, such as Google, is to balance the interests of advertisers buying the ads, publishers displaying the ads, and consumers viewing the ads. In some cases, pricing on one side of the trade will subsidize participation on another side, increasing the value to all sides combined.

At the heart of Paxton’s lawsuit is the belief that the exchanges run by Google and other large digital advertising firms simultaneously overcharge advertisers, underpay publishers, and pocket the difference. Google’s critics allege the company leverages its ownership of Search, YouTube, and other services to coerce advertisers to use Google’s ad-buying tools and Google’s exchange, thus keeping competing firms away from these advertisers. It’s also claimed that, through its Search, YouTube, and Maps services, Google has superior information about consumers that it won’t share with publishers or competing digital advertising companies.

These claims are based on the premise that “big is bad,” and that dominant firms have a duty to ensure that their business practices do not create obstacles for their competitors. Under this view, Google would be deemed anticompetitive if there is a hypothetical approach that would accomplish the same goals while fostering even more competition or propping up rivals.

But U.S. antitrust law is supposed to foster innovation that creates benefits for consumers. The law does not forbid conduct that benefits consumers on grounds that it might also inconvenience competitors, or that there is some other arrangement that could be “even more” competitive. Any such conduct would first have to be shown to be anticompetitive—that is, to harm consumers or competition, not merely certain competitors.

That means Paxton has to show not just that some firms on one side of the market are harmed, but that the combined effect across all sides of the market is harmful. In this case, his suit really only discusses the potential harms to publishers (who would like to be paid more), while advertisers and consumers have clearly benefited from the huge markets and declining advertising prices Google has helped to create.

While we can’t be sure how the Texas case will develop once its allegations are fleshed out into full arguments and rebutted in court, many of its claims and assumptions appear wrongheaded. If the court rules in favor of these claims, the result will be to condemn conduct that promotes competition and potentially to impose costly, inefficient remedies that function as a drag on innovation.

Paxton and his fellow attorneys general should not fall for the fallacy that their vision of a hypothetical ideal market can replace a well-functioning real market. This would pervert businesses’ incentives to innovate and compete, and would make an unobtainable perfect that exists only in the minds of some economists and lawyers the enemy of a “good” that exists in the real world.

[For in-depth analysis of the multi-state suit against Google, see our recent ICLE white paper “The Antitrust Assault on Ad Tech.”]