There is an emerging debate regarding whether complexity theory—which, among other things, draws lessons about uncertainty and non-linearity from the natural sciences—should make inroads into antitrust (see, e.g., Nicolas Petit and Thibault Schrepel, 2022). Of course, one might also say that antitrust is already quite late to the party. Since the 1990s, complexity theory has made inroads into numerous “hard” and social sciences, from geography and urban planning to cultural studies.

Depending on whom you ask, complexity theory is everything from a revolutionary paradigm to a lazy buzzword. What would it mean to apply it in the context of antitrust and would it, in fact, be useful?

Given its numerous applications, scholars have proposed several definitions of complexity theory, invoking different kinds of complexity. According to one, complexity theory is concerned with the study of complex adaptive systems (CAS)—that is, networks that consist of many diverse, interdependent parts. A CAS may adapt and change, for example, in response to past experience.

That does not sound too strange as a general description either of the economy as a whole or of markets in particular, with consumers, firms, and potential entrants among the numerous moving parts. At the same time, this approach contrasts with orthodox economic theory—specifically, with the game-theory models that rule antitrust debates and that prize simplicity and reductionism.

As both a competition economist and a history buff, my primary point of reference for complexity theory is a scholarly debate among Bronze Age scholars. Sound obscure? Bear with me.

The collapse of several flourishing Mediterranean civilizations in the 12th century B.C. (Mycenae and Egypt, to name only two) puzzles historians as much as today’s economists are stumped by the question of whether any particular merger will raise prices.[1] Both questions encounter difficulties in gathering sufficient data for empirical analysis (the lack of counterfactuals and foresight in one case, and 3,000 years of decay in the other), forcing a recourse to theory and possibility results.

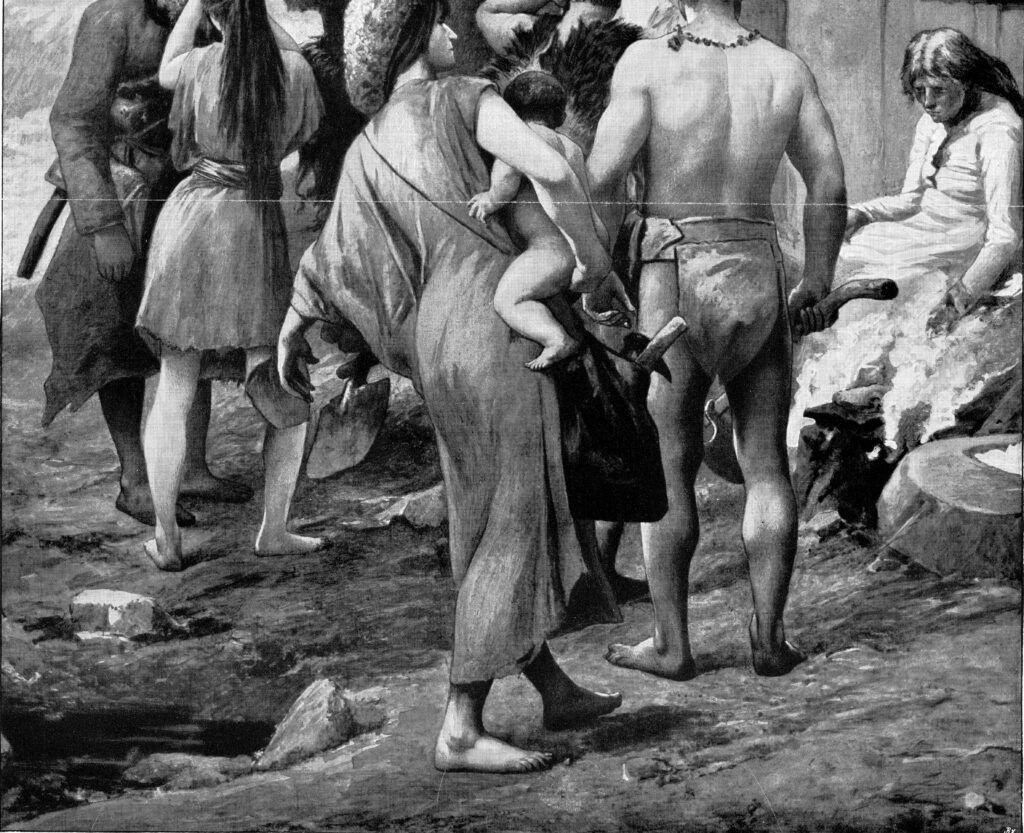

Earlier Bronze Age scholarship blamed the “Sea Peoples,” invaders of unknown origin (possibly Sicily or Sardinia), for the destruction of several thriving cities and states. The primary source for this thesis was statements attributed to the Egyptian pharaoh of the time. More recent research, while acknowledging the role of the Sea Peoples, but has gone to lengths to point out that, in many cases, we simply don’t know. Alternative explanations (famine, disease, systems collapse) are individually unconvincing as alternative explanations, but might each have contributed to the end of various Bronze Age civilizations.

Complexity theory was brought into this discussion with some caution. While acknowledging the theory’s potential usefulness, Eric Cline writes:

We may just be applying a scientific (or possibly pseudoscientific) term to a situation in which there is insufficient knowledge to draw firm conclusions. It sounds nice, but does it really advance our understanding? Is it more than just a fancy way to state a fairly obvious fact?

In a review of Cline’s book, archaeologist Guy D. Middleton agreed that the application of complexity theory might be “useful” but also “obvious.” Similarly, in the context of antitrust, I think complexity theory may serve as a useful framework to understand uncertainty in the marketplace.

Thinking of a market as a CAS can help to illustrate the uncertainty behind every decision. For example, a formal economic model with a clear (at least, to economists) equilibrium outcome might predict that a certain merger will give firms the incentive and ability to reduce spending on research and development. But the lens of complexity theory allows us to better understand why we might still be wrong, or why we are right, but for the wrong reasons.

We can accept that decisions that are relevant and observable to antitrust practitioners (such as price and production decisions) can be driven by things that are small and unobservable. For example, a manager who ultimately calls the shots on R&D budgets for an airplane manufacturer might go to a trade fair and become fascinated by a cool robot that a particular shipyard presented. This might have been the key push that prompted her to finance an unlikely robotics project proposed by her head engineer.

Her firm is, indeed, part of a complex system—one that includes the individual purchase decisions of consumers, customer feedback, reports from salespeople in the field, news from science and business journalists about the next big thing, and impressions at trade fairs and exhibitions. These all coalesce in the manager’s head and influence simple decisions about her R&D budget. But I have yet to see a merger-review decision that predicted effects on innovation from peeking into managers’ minds in such a way.

This little story might be a far-fetched example of the Butterfly Effect, perhaps the most familiar concept from complexity theory. Just as the flaps of a butterfly’s wings might cause a storm on the other side of the world, the shipyard’s earlier decision to invest in a robotic manufacturing technology resulted in our fictitious aircraft manufacturer’s decision to invest more in R&D than we might have predicted with our traditional tools.

Indeed, it is easy to think of other small events that can have consequences leading to price changes that are relevant in the antitrust arena. Remember the cargo ship Ever Given, which blocked the Suez Canal in March 2021? One reason mentioned for its distress were unusually strong winds (whether a butterfly was to blame, I don’t know) pushing the highly stacked containers like a sail. The disruption to supply chains was felt in various markets across Europe.

In my opinion, one benefit of admitting this complexity is that it can make ex post evaluation more common in antitrust. Indeed, some researchers are doing great work on this. Enforcers are understandably hesitant to admit that they might get it wrong sometimes, but I believe that we can acknowledge that we will not ultimately know whether merged firms will, say, invest more or less in innovation. Complexity theory tells us that, even if our best and most appropriate model is wrong, the world is not random. It is just very hard to understand and hinges on things that are neither straightforward to observe, nor easy to correctly gauge ex ante.

Turning back to the Bronze Age, scholars have an easier time observing that a certain city was destroyed and abandoned at some point in time than they do in correctly naming the culprit (the Sea Peoples, a rival power, an earthquake?) The appeal of complexity theory is not just that it lifts a scholar’s burden to name one or a few predominant explanations, but that it grants confidence that the decision itself arose out of a complex system: the big and small effects that factors such as famine, trade, weather, and fortune may have had on the city’s ability to defend itself against attack, and the individual-but-interrelated decisions of a city’s citizens to stay or leave following a catastrophe.

Similarly, for antitrust experts, it is easier to observe a price increase following a merger than to correctly guess its reason. Where economists differ from archaeologists and classicists is that they don’t just study the past. They have to continue exploring the present and future. Imagine that an agency clears a merger that we would have expected not to harm competition, but it turns out, ex post, that it was a bad call. Complexity theory doesn’t just offer excuses for where reality diverged from our prediction. Instead, it can tell us whether our tools were deficient or whether we made an “honest mistake.” As investigations are always costly, it is up to the enforcer (or those setting their budget) to decide whether it makes sense to expand investigations to account for new, complex phenomena (reading the minds of R&D managers will probably remain out of the budget for the foreseeable future).

Finally, economists working on antitrust problems should not see this as belittling their role, but as a welcome frame for their work. Computing diversion ratios or modeling a complex market as a straightforward set of equations might still be the best we can do. A model that is right on average gets us closer to the right answer and is certainly preferred to having no clue what’s going on. Where we don’t have precedent to guide us, we have to resort to models that may be wrong, despite getting everything right that was under our control.

A few things that Petit and Schrepel call for are comfortably established in the economist’s toolkit. They might not, however, always be put to use where they should. Notably, there are feedback loops in dynamic models. Even in static models, it is possible to show how a change in one variable has direct and indirect (second order) effects on an outcome. The typical merger investigation is concerned with short-term effects, perhaps those materializing over the three to five years following a merger. These short-term effects may be relatively easy to approximate in a simple model. Granted, Petit and Schrepel’s article adopts a wide understanding of antitrust—including pro-competitive market regulation—but this seems like an important caveat, nonetheless.

In conclusion, complexity theory is something economists and lawyers who study markets should learn more about. It’s a fascinating research paradigm and a framework in which one can make sense of small and large causes having sometimes unpredictable effects. For antitrust practitioners, it can advance our understanding of why our predictions can fail when the tools and approaches that we use are limited. My hope is that understanding complexity will increase openness to ex-post valuation and the expectations toward antitrust enforcement (and its limits). At the same time, it is still an (economic) question of costs and benefits as to whether further complications in an antitrust investigation are worth it.

[1] A fascinating introduction that balances approachability and source work is YouTube’s Extra History series on the Bronze Age collapse.