Featured

Recently

Published

In an April 17 address to United Steelworkers in Pittsburgh, President Joe Biden vowed that his administration would “thwart the acquisition of U.S. Steel by a Japanese company,” Nippon Steel, telling the assembled union members that U.S. Steel “has been an iconic American company for more than a century and it should remain totally American.” … Steeling to Block a Merger

Last week was the occasion of the “spring meeting”; that is, the big annual antitrust convention in Washington, D.C. hosted by the American Bar Association (ABA) Antitrust Section. To engage in a bit of self-plagiarism (efficient for me, at least), I had this to say about it last year: For those outside the antitrust world, … Antitrust at the Agencies Roundup: Spring Has Sprung

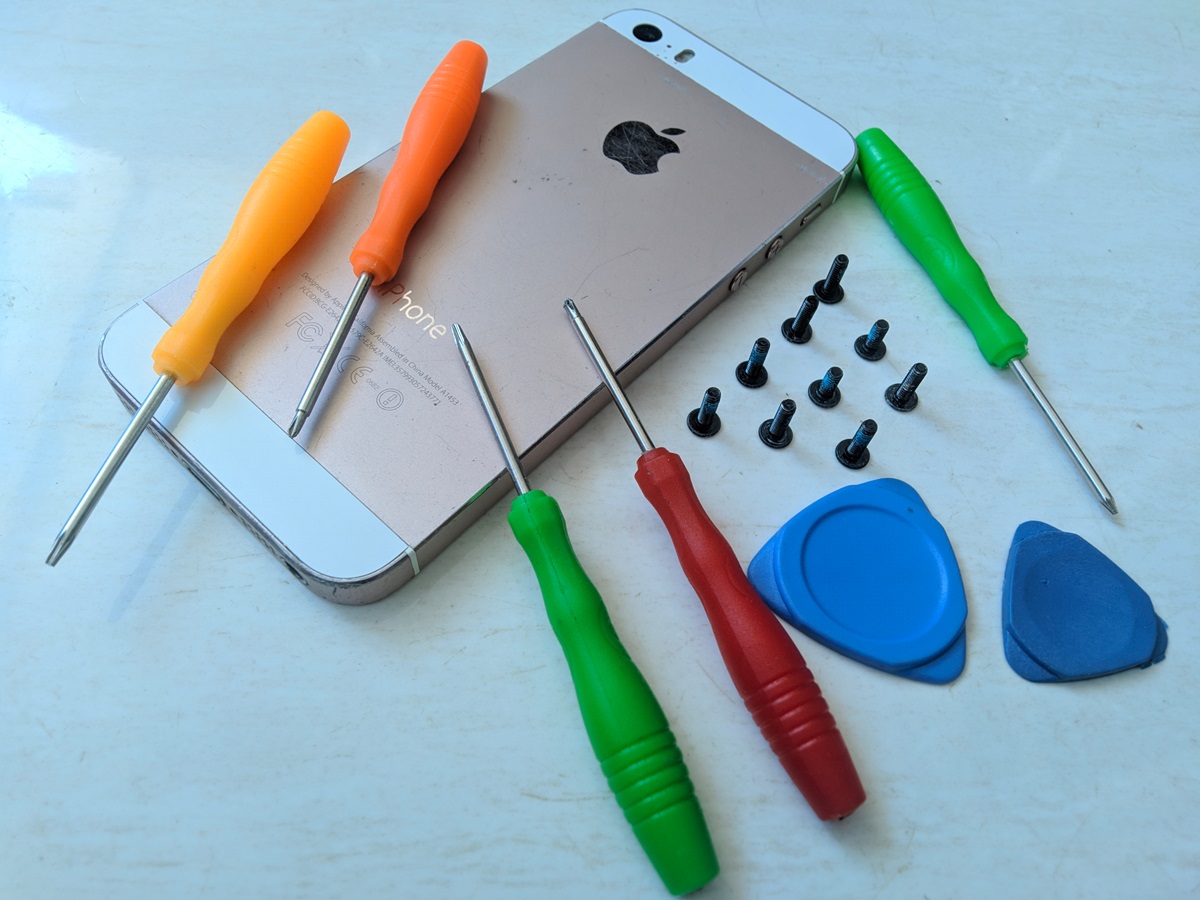

The U.S. Justice Department’s (DOJ) recent complaint charging Apple with monopolizing smartphone markets is, according to Assistant U.S. Attorney General Jonathan Kanter, intended as a contribution to the agency’s “enduring legacy of taking on the biggest and toughest monopolies in history.” Unfortunately, the case has fundamental weaknesses in its assessment of both Apple’s alleged monopoly … DOJ’s Case Against Apple: Beware of Forcing ‘Efficiencies’